Loading

EP 573 | AIRED 01/24/2022

New 2022 Halibut Fishery Limit, 2021 Recap, 2022 Outlook

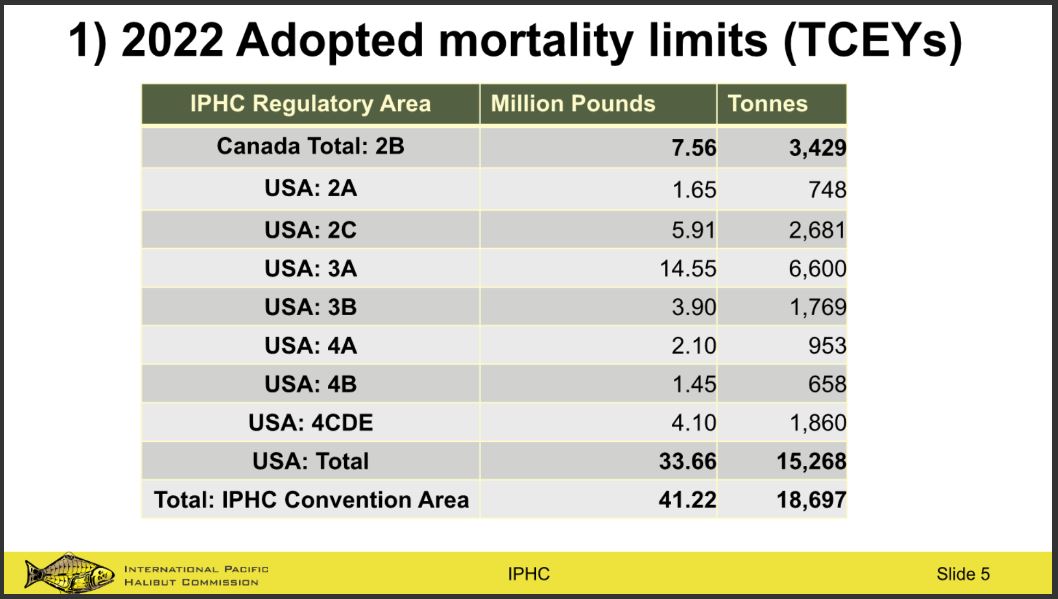

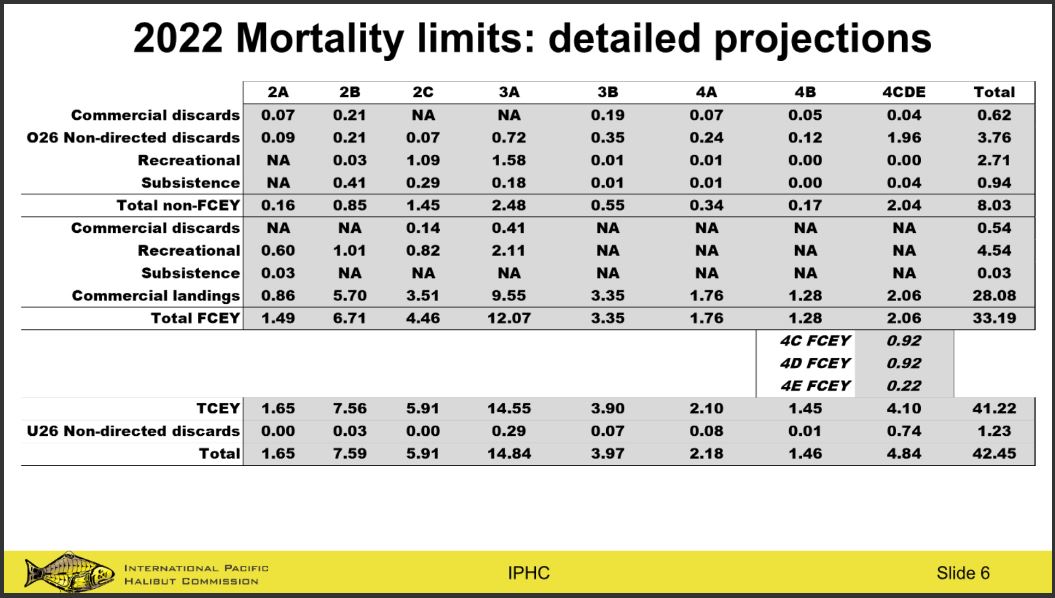

January 28, 2022 Update: The International Pacific Halibut Commission has confirmed this morning during day five of their Annual Meeting that the 2022 TCEY for the Pacific Halibut Fishery to be set at 41.22 million lbs - up from the TCEY of 39 million pounds in 2021, 36.60 million pounds in 2020 and 38.61 in 2019.

Jan 24th, 2022 --- This week we sneak in a Pacific Halibut update just days before the International Pacific Halibut Commission is set to reach a decision on the fishing limits for the 2022 Commercial Pacific Halibut Fishery.

At an SPR level of 43 percent, the 2022 Total Constant Exploitation Yield (also known as the TCEY) would equate to 41.2 million lbs - another increase when compared to previous seasons. (39 million pounds in 2021, 36.60 million pounds in 2020 and 38.61 in 2019).

Through the IPHC’s Management Strategy Evaluation process, a coastwide fishing intensity corresponding to an SPR of 43 percent has been found to meet the Commission’s objectives of avoiding stock sizes that would be associated with conservation concern, maximizing fishery yield and minimizing fishery variability.

There are many factors the Commission will consider this week during their 98th Annual Meeting before reaching a final TCEY value in which the final decision will be made Friday January 28th.

Projections from the IPHC’s most recent stock assessment are more optimistic than those from the 2019 and 2020 assessments due to the increasing projected maturity of the 2012 year-class.

Although results from the stock assessment indicate that the Pacific Halibut stock declined continuously from the late 1990’s to around 2012, age data through 2021 suggest that the 2012 year-class will mature over the next few years and contribute importantly to trends in spawning biomass.

This translates to a lower probability of stock decline for 2022 than in recent assessments as well as a decrease in this probability through 2023-24.

Now moving onto the market info.

The Pacific Halibut fishery typically runs from March to December and fresh Halibut is typically what hits the market first until around May when processors typically start freezing fish..

However, as we are still in the midst of a pandemic with supply chain constraints, inflation, and consumers continuing to eat a majority of meals at home, we think it’s safe to anticipate that we’ll experience yet another year of untypical market timings.

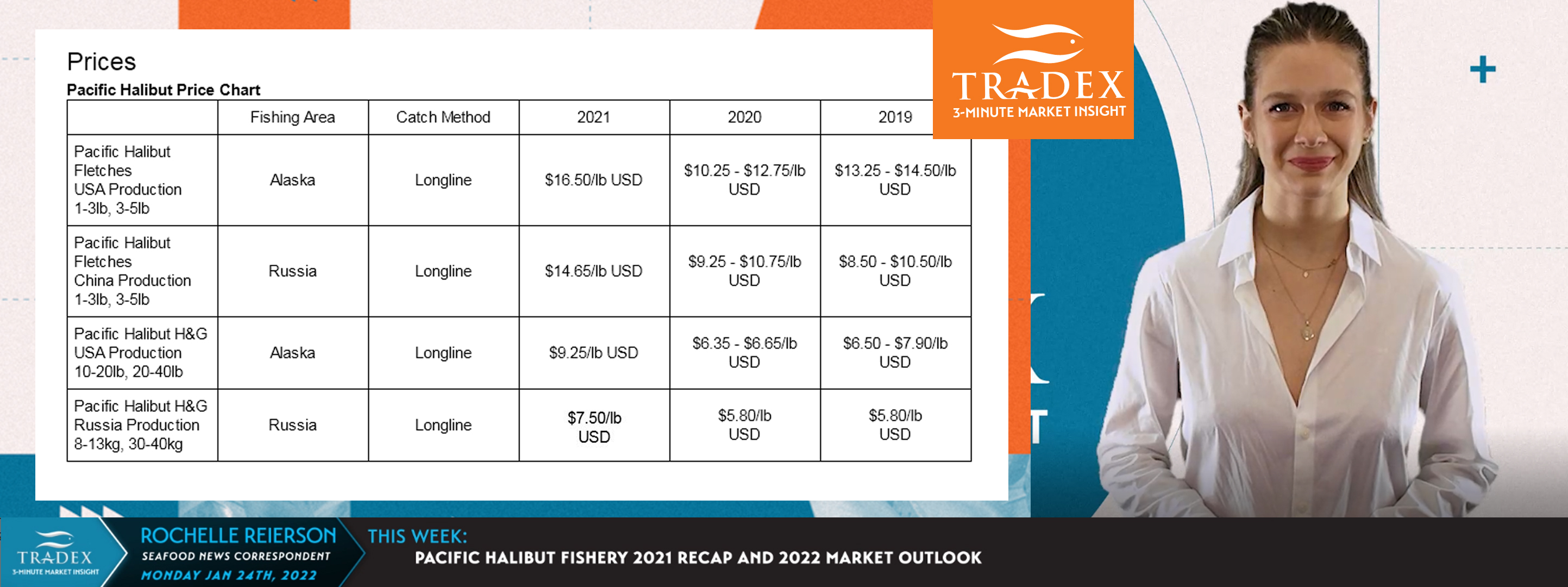

The general theme for Pacific Halibut in 2021 was that it was high in demand, hard to secure, and expensive with upward pressure on pricing throughout the year.

Pacific Halibut is typically sold to upscale retail outlets and white-tablecloth restaurants however amidst the pandemic, Pacific Halibut products actually saw an increase in online sales following the general trend for more seafood products consumption at home.

Advertise Here: advertising@tradexfoods.com

In 2021, fresh Alaskan Halibut fillets routinely sold for 24 to 28 dollars per pound US and upwards to 38 dollars per pound at outfits like Pike Place Market in downtown Seattle.

Online, Pacific Halibut fillets retailed in late 2021 at about 35 to 48 dollars per pound US for fillet portions and 35 to 36 dollars per pound for steaks.

Pacific Halibut entrees at the restaurants in metropolitan areas typically sell for 37 to 43 dollars US a dish (typically utilizing a 6oz portion) which translates to about 100 to 115 dollars US per pound.

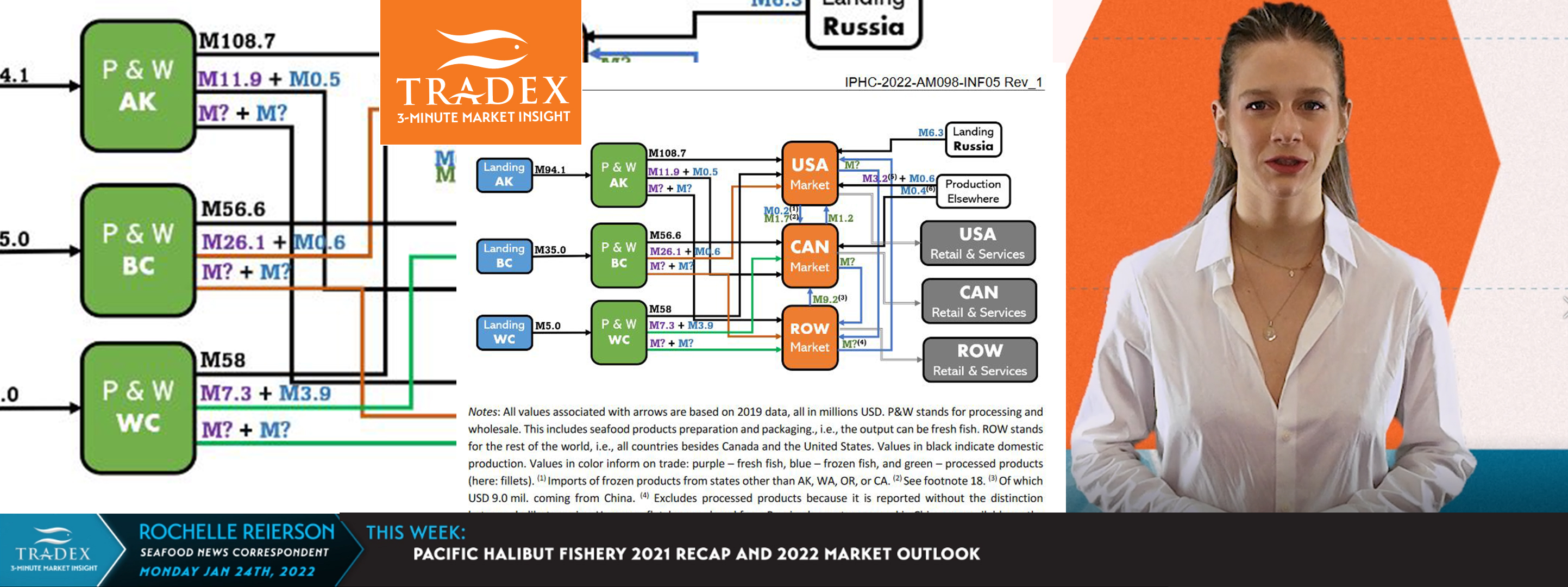

Total consumer spending on Pacific Halibut products in the USA are assessed at 460 million dollars US, and in Canada, 232 million dollars US.

On the processing side, it’s estimated that total value-added activity related to Pacific Halibut products in the USA amounted to 230 million dollars US, and in Canada, 140 million dollars US.

Our recommendation this year is to make pre-commitments on your Pacific Halibut needs with your supplier as the demand for fresh and frozen seafood is forecasted to increase even further in 2022.

On a last note, this chart you just saw summarizes market flows for Pacific Halibut from the landing area to retail and services, accounting for trade balance in fresh, frozen, and processed products.

This chart was from the IPHC’s recent Pacific Halibut Market Profile report which contains a wealth of other market info on Pacific Halibut.

This chart was from the IPHC’s recent Pacific Halibut Market Profile report which contains a wealth of other market info on Pacific Halibut.

We’ve provided a link to this report here:

--- If you are not already, be sure to subscribe to our 3-Minute Market Insight using the signup form below to keep tuned-in to all upcoming market insights.