This week’s 3-Minute Market Insight is brought to you by GQ Freight.

GQ Freight, an industry leader, recognizing that real time GPS tracking of your Refrigerated Truckload Shipments is no longer a Luxury, but a Necessity.

GQ Freight, Excellence Delivered. On Time, Every Time.

Web: www.gqfreight.com

Phone: 1-305-280-0913

LinkedIn: www.linkedin.com/in/GQFreight

August 6, 2018 -China is still the world's largest seafood producer, increasing seafood production by 1.4 percent year-to-year to almost 70 million metric tonnes in 2017.

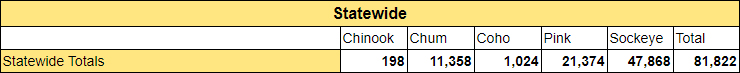

2018 Alaska Salmon Commercial Harvest Counter

(Harvest in thousands of fish)

Updated: TUES AUG 7 2018 7:00AM (View Previous Weeks Totals)

A few years ago, financial problems hit Qingdao in the largest seafood processing region of China, Shandong.

Many of the biggest plants in the region shut down after being unable to secure loans from their banks during the financial crisis.

2 large plants went bankrupt at the beginning of this year and even large, successful plants who underwent massive expansion this year cannot increase credit lines.

For seafood plants, this means raw materials are purchased hand-to-mouth, which constricts their production capacity.

This will constrain purchases of Raw Material for all species, but it will affect Salmon in particular.

Unlike Pollock and Cod, there is just one time to secure Salmon for the entire year, so some plants will have to shut down if they cannot pay for raw materials, or they will be forced to swtich to other species.

For seafood buyers, this means production schedules have never been tigher.

Price quotes are only valid for one to two weeks as raw materials are purchased to secure shorter production periods.

We have seen prices increase slowly and steadily every month for the last 3 months during this period of financial trouble.

China labour costs are also up as the minimum wage in the Qingdao region raised 5.8 percent in 2017 and a dramatic 17.7 percent in Dalian since the spring of 2016.

Seafood Buyers are recommended look at least 4 months in advance for contracts or inventory or opportunities will be missed.

And lastly, the proposed 25 percent tariff on Chinese seafood products into the USA from the Trump Administration could disrupt the entire supply chain.

Little is known about the effective date as discussions are still underway, but it's expected that by early September a decision will be made.

--- To wrap this episode up, our TradexLIVE offer of the week is for 8-16oz Sinbad Pacific Cod Fillets. We have 15,000 lbs of #1 quality, twice frozen, shatterpack fillets available in LA for $2.99/lb.

If you have a topic you'd like to hear on upcoming 3-Minute Market Insights tweet us @TradexFoods or suggest a topic through YouTube or Facebook

Copyright © Tradex Foods Seafood News

Copyright © Tradex Foods Inc. All Rights Reserved.