Loading

EP 505 | AIRED 09/14/2020

Tilapia Market & Production Update

September 14th, 2020 --- In this week's episode we're giving you the latest update on the Tilapia Market, and how production is faring amidst covid-19.

Regardless of the Covid-19 situation that has put a majority of production and international trade on hold, Tilapia exports from China have remained consistent and undisrupted..

Due to Chinese New Year, the pandemic hit right as plants were beginning to shut down for the holiday.

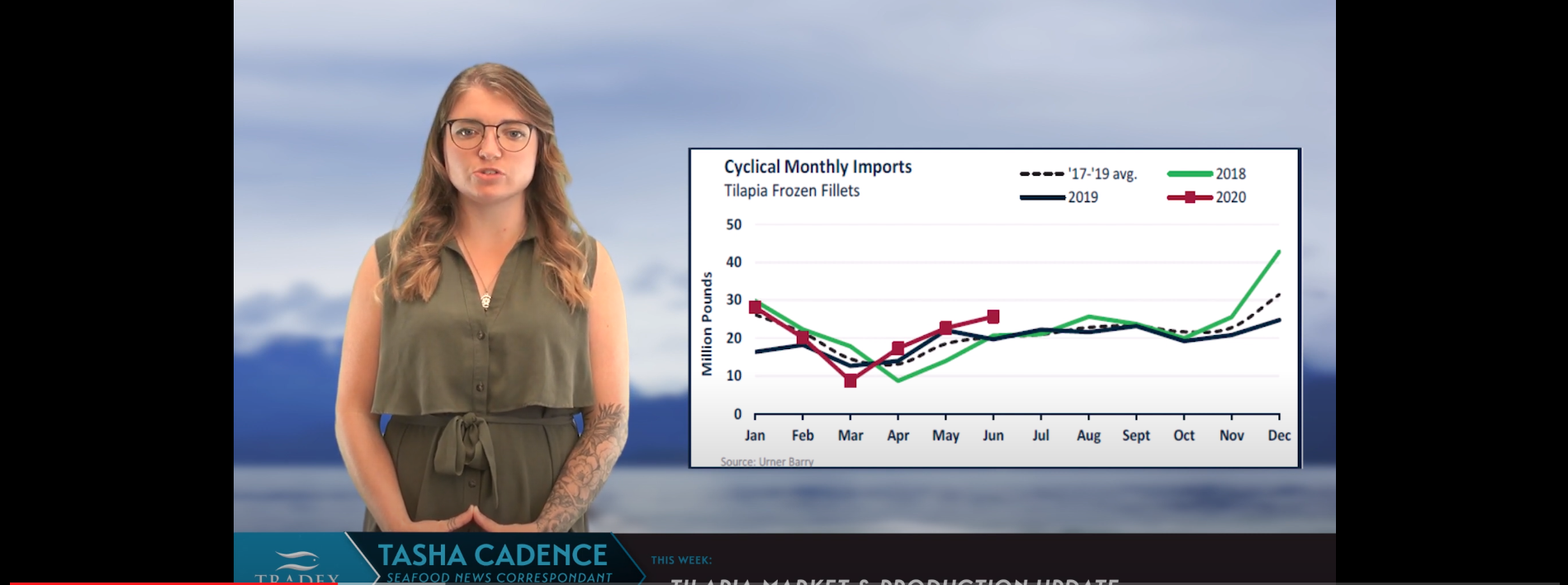

2020's spring's exports was only marginally smaller than previous years, the three year average for this time is around 13 million pounds.

Due to the preparation for Lent, yearly planning of imports put Tilapia supplies in a good position before international restrictions were put in place.

For the summer, export numbers have increased to nearly 30 million pounds exported in July..

--- Production plants in China were closed or slowed immensely for just under a two month period, which saw the Tilapia fish growing larger than normal.

At the moment, smaller sized fillets are high in demand and difficult to find.

--- Since September 2018, Tilapia fillets from China have had a tariff assessed on all US imports, which was set at 25% since May 2019.

An exclusion was requested and granted for fillets weighing no more than 115g, which meant 2-3oz fillets were excluded from the extra 25% duty.

However, exclusions have expiration dates and many of the 25% tariffs on whitefish were set to expire last month on August 7th.

Importers of Flounder and Haddock were relieved to see exclusions renewed to December 31 2020, but Tilapia importers were not so lucky.

The 2-3oz Tilapia fillet exclusion expired and ALL Tilapia products are now assessed a 25% tariff.

According to Urner Bary's Seafood Report from August 31st, reports of higher temperatures causing pond water levels to fall has been putting pressure on farming efforts.

Now, earlier catch of smaller sized fish were reported because of this weather - related event.

Since then, demand has switched from 3-5 oz and 2-5oz sized fillets to the smaller 2-3 oz size.

Current pricing for 3-5 oz. frozen fillets is sitting at around $2.10/lb USD, 15 cents higher than last year and almost a full 50 cents higher than the 3 year-average.

With the constant uncertainty of tariff related pressure and delayed tilapia production, feed shortages, limited processing activity in the wake of Covid-19, it's reported that CFR's are at all-time lows.

Alternative suppliers such as the Latin American producers, such as Brazil are still focusing primarily on fresh tilapia fillets, while competitors in China are cautious to invest due to all the uncertainty.

We've hear from our sources in China, that the majority of production has switched from foodservice to retail packs, as retail is the dominant for demand right now.

--- Our recommendation is to stock up on smaller sized fillets while supply still exists, as Chinese production is moving very slowly under it's limited operational capabilities.

Keep tuned-in to your 3-Minute Market Insight as we keep you up to date on the state of Tilapia and other species, as production facilities begin to reopen.