Loading

EP 507 | AIRED 09/28/2020

Russian Pink & Chum vs Alaska’s Salmon Season

September 28, 2020 --- This week we report on Russia's Pink and Chum Salmon Harvest and compare it to Alaska's 2020 Salmon Season as it winds down - to then provide a sense of market conditions for Global Wild Salmon Production.

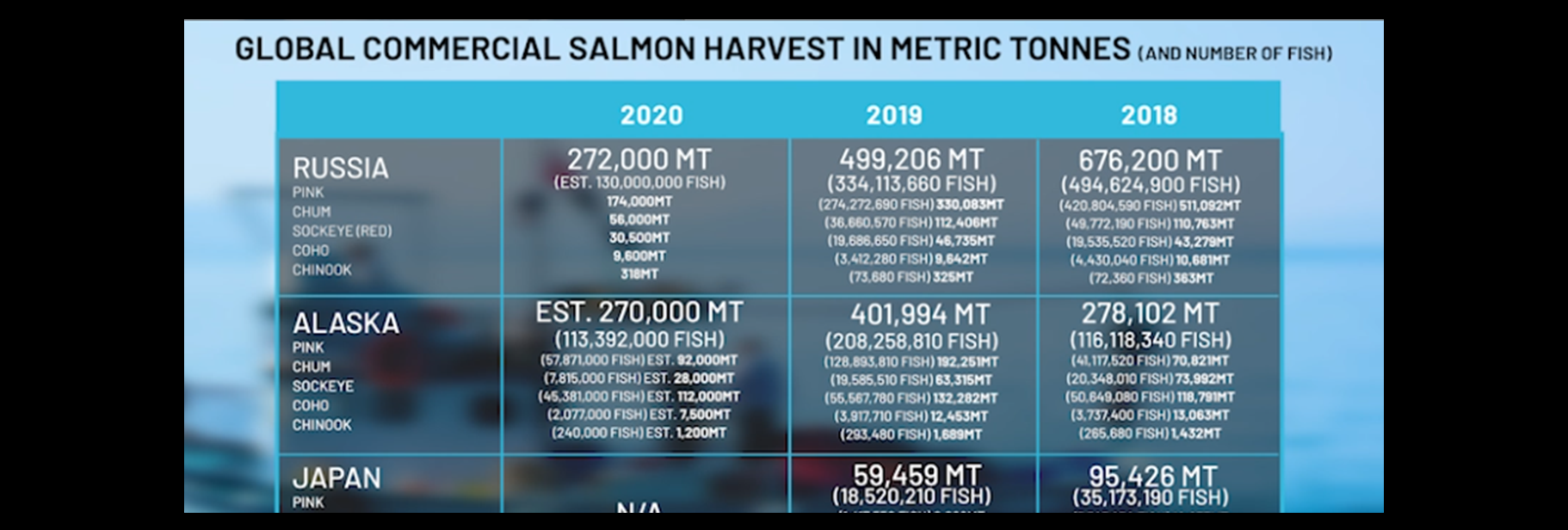

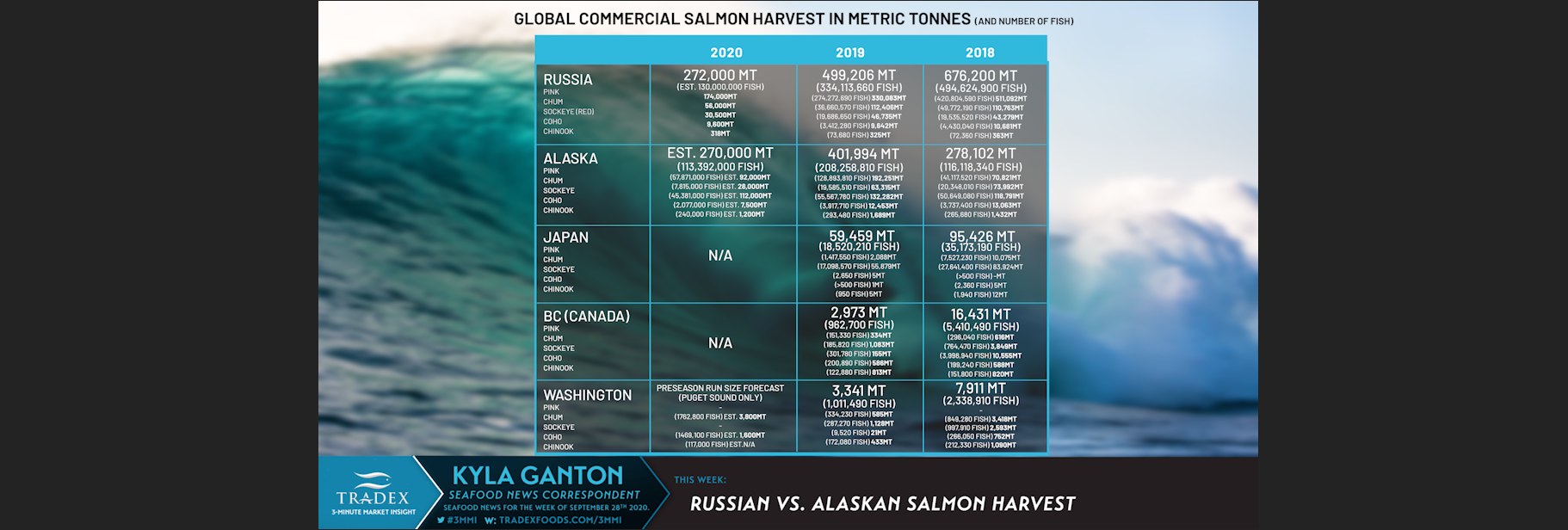

With under 2 months left in Russia's Pacific Salmon Fishery, just over 272,000 metric tonnes have been harvested which is about 50 percent less than in 2018, and 40 percent less than in 2019.

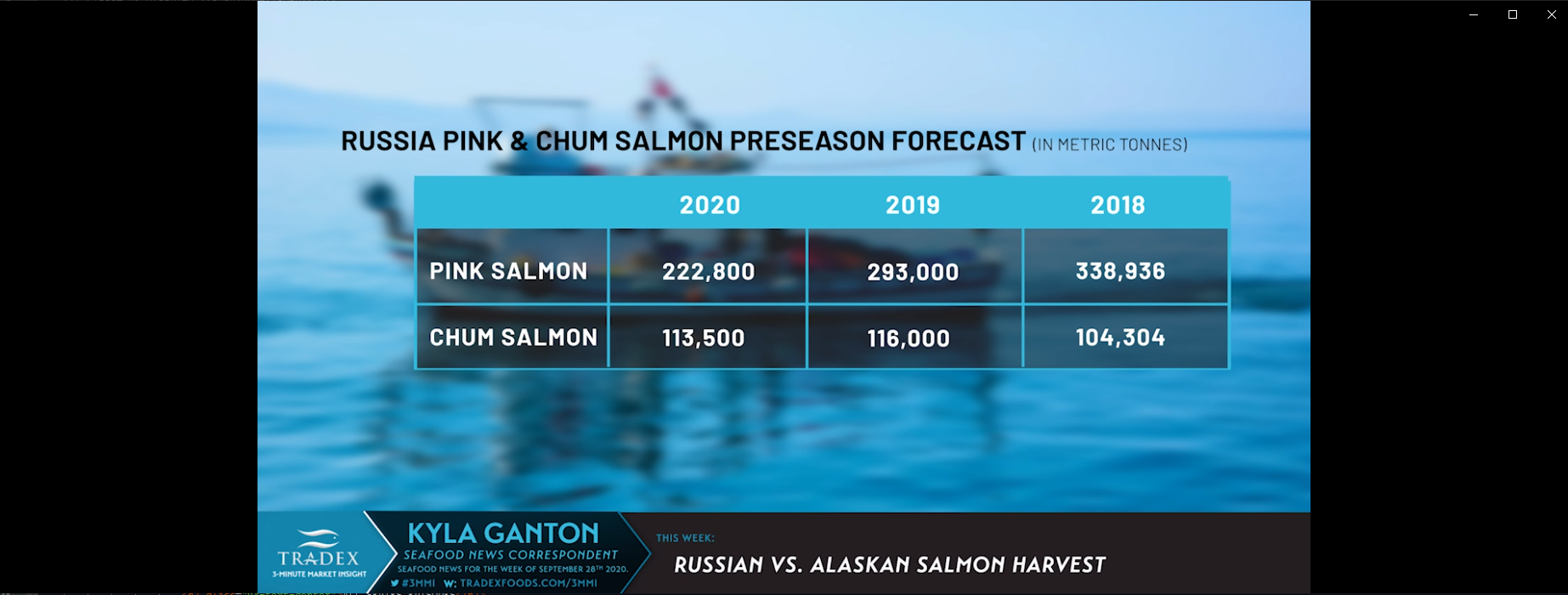

Narrowing down on Pinks and only 174,000 metric tonnes have been harvested down about 65 percent from 2018's harvest of 511,000 metric tonnes.Preseason forecast for 2020 Pinks in Russia called for about 222,000 metric tonnes down about 30 percent from 2018's preseason forecast of 338,000 metric tonnes.

Moving onto Russian Chum's and only 56,000 metric tonnes have been harvested down about 50 percent from 2019's harvest of 112,000 metric tonnes.

Preseason forecast for 2020 Chums in Russia called for about 113,000 metric tonnes down about 2 percent from 2019's preseason forecast of 116,000 metric tonnes.

--- In speaking with our VP of Asia Operations and the situation in China is that Russian Salmon has been really short and boats have been continually raising their prices.

Raw materials pricing on Chums have made a bull run from $3800 per metric tonne (or $1.70/lb USD) about a month ago to $4600 per metric tonne right now which translates to about $2.00/lb USD.

Pink Salmon raw materials are caught up in a similar situation in China going from $2600 to $3400 per metric tonne - or about $1.20/lb and $1.55/lb USD respectively.

Going back a few weeks it was reported that Russian boats did not even want to make commitments at the higher prices as they wanted pricing at even higher levels.

About 300 tons of Pinks should have arrived into Dalian late last week where one plant owner has informed they want plants to bid on the product raising concerns that you may not even secure fish at the $3400 price point.

For now, we don't believe the market is ready for these prices which has even forced some plants to turn to Alaskan suppliers however inventories of Alaskan Chums are essentially drained.

Our recommendation to buyers is to secure whatever inventories you can as there is no end in sight to where prices will climb up to this season.

--- Now moving on to Alaska as the 2020 Salmon Season comes to a close.

Over 113 million Wild Pacific Salmon have been harvested which translates to about 85 percent of the preseason forecast of 132 million fish.

Although many runs struggled this year it's not all bad news as Bristol Bay once again produced a robust harvest of over (or nearly) 200 million pounds of Sockeye for the 5th year in a row.

Now let's go to Andy Wink - EXECUTIVE DIRECTOR of the Bristol Bay Regional Seafood Development Association to give us commentary on how this season played out and to also provide some insight into what things might look like in the future.

[Andy Wink] "Outside of Bristol Bay and a few pink salmon fisheries, this was a very poor year for Alaska's salmon industry. Alaska's chum salmon harvests were down 61%, coho was down 49%, and harvests in non-Bristol Bay sockeye fisheries were down 50%. Luckily, sockeye harvests were once again abundant in Bristol Bay as fishermen caught nearly 200 million pounds. Although that's a bigger than average harvest for Bristol Bay, it's still down 9% from last year. With lower sockeye harvests in Russia and closures in Canada, we estimate the global sockeye harvest declined by 26% in 2020.

Bristol Bay's salmon industry and local medical facilities did an amazing job of controlling the COVID-19 virus, but the virus resulted in a much lower base price given the increase in market uncertainty and COVID-19 mitigation costs. However, with strong demand for healthy, wild salmon and a drastic decline in supply, we expect wholesale pricing will remain high, if not go higher as limited supplies are drawn down ahead of next season. If that happens, I think there's an expectation from the fleet that they would see some price adjustments from processors later this year. Or at the very least to engage the fishermen to explain why the ex-vessel price had to be so much lower in 2020. Despite the disappointing price to fishermen this year, the future for Bristol Bay looks great. All the river systems met escapement goals, we've had five years in a row of large harvests, and consumer demand is very strong.

As a service to the supply chain, BBRSDA offers a regional brand for Bristol Bay sockeye that provides marketing assets and promotional assistance to anyone selling Bristol Bay sockeye. Our goal with this brand is to help retailers, distributors, direct marketers, and anyone else selling Bristol Bay sockeye tell the story of this amazing fishery. We've got incredible pictures, a modern brand design, ready-to-use social media content, a recipe library, sales assets, retail training resources, fishermen profiles, and much more. People can visit marketing.bristolbaysockeye.org for more info.

The Pebble Mine has been in the news this week as a series of tapes were released that prove Pebble misled the Army Corps and public about the true scope of it's mining project, as well as bragging about their ability to manipulate politicians. We think this year's salmon season and these tapes underscore how important it is to keep Bristol Bay's salmon habitat pristine. Bristol Bay has been the only consistently abundant source of premium wild salmon this year, and in recent years."

With Russia's contribution of an estimated 130 million fish (from 272,000 metric tonnes), we can conclude that global markets will see atleast 542,000 metric tonnes of new season Salmon from two of the worlds largest Wild Pacific Salmon producers (Alaska and Russia).

Japan is the thrid largest producer of Wild Pacific Salmon contributing 59,000 and 95,000 metric tonnes (from 18 million and 35 million fish) in 2019 and 2018 respectively however a large portion of their harvest get used to service their domestic markets.

--- In British Columbia Canada, the 2020 Salmon season is expected to be worse than 2019 where less than 3,000 metric tonnes were commercially harvested from about 900,000 fish.

Compare this to a bumper year such as 2014 where over 37,000 metric tonnes of Wild Pacific Salmon were harvested from 14.8 million fish.

--- As for Salmon from Washington State, the Puget Sound fishery is set to start in October with preseason run size forecast of 762,000 Chums and 469,000 Coho's.

Fishery managers out the Washington Department of Fish and Wildlife are warning of another tough year.

Commercial harvest of Chum Salmon in the state of Washington totalled 287,000 fish in 2019 compared to 849,000 in 2018, and 1.4 million in 2017.

If you're not already, be sure to subscribe to our 3-Minute Market Insight by signing up in the form below to keep tuned into all future market insights.