Loading

EP 649 | AIRED 07/17/2023

China Update: Businesses Struggling, Strong Migas Demand, Buyers Switch to Pale Meat, EU Supermarket Request, Big Pink Year

July 17th, 2023 - The seafood business in China continues facing challenges as Chinese plants struggle to find orders.

Haddock raw material prices have dropped and plants are hesitant to even process the fish into finished products.

Russian boats are offering Pacific Cod to plants in China, but they are not receiving counter offers due to low demand in the EU and North America.

Chinese plants are selling Pink and Chum Salmon at lower prices to make room for new arrivals, similar to the 2008 situation when prices dropped significantly.

One large plant that opened their first inland facility in an attempt to improve margins, plans to open more plants if that one is successful.

This facility located 500 kilometers inland is said to have labour cost of about 60-70 percent of what they are in Qingdao.

Plants anticipated a pickup in business by June but there are no signs of this yet, and the EU market is impacted by the energy crisis and inflation.

EU supermarkets started requesting pricing for 2 by 125g retailed Salmon (both Pink and Chum) and many buyers have switched from “Good Meat Color” to “Pale” because of price.

Advertise Here: advertising@tradexfoods.com

Demand for Atlantic & Pacific Cod migas is strong as customers push for shipments, while production limitations in Alaska and Norway have led buyers to rely on Chinese plants instead for purchasing pieces and collars, with the Pollock market experiencing a decline.

Chinese plants holding Pollock inventory since January are now desperate to sell at prices below their costs due to the accumulating holding costs.

Plants are also hesitant to buy Pink Salmon even at reduced prices due to market uncertainty and are expecting Pink Salmon prices in the upcoming season to range from $2,500 to $3,000 per metric tonne.

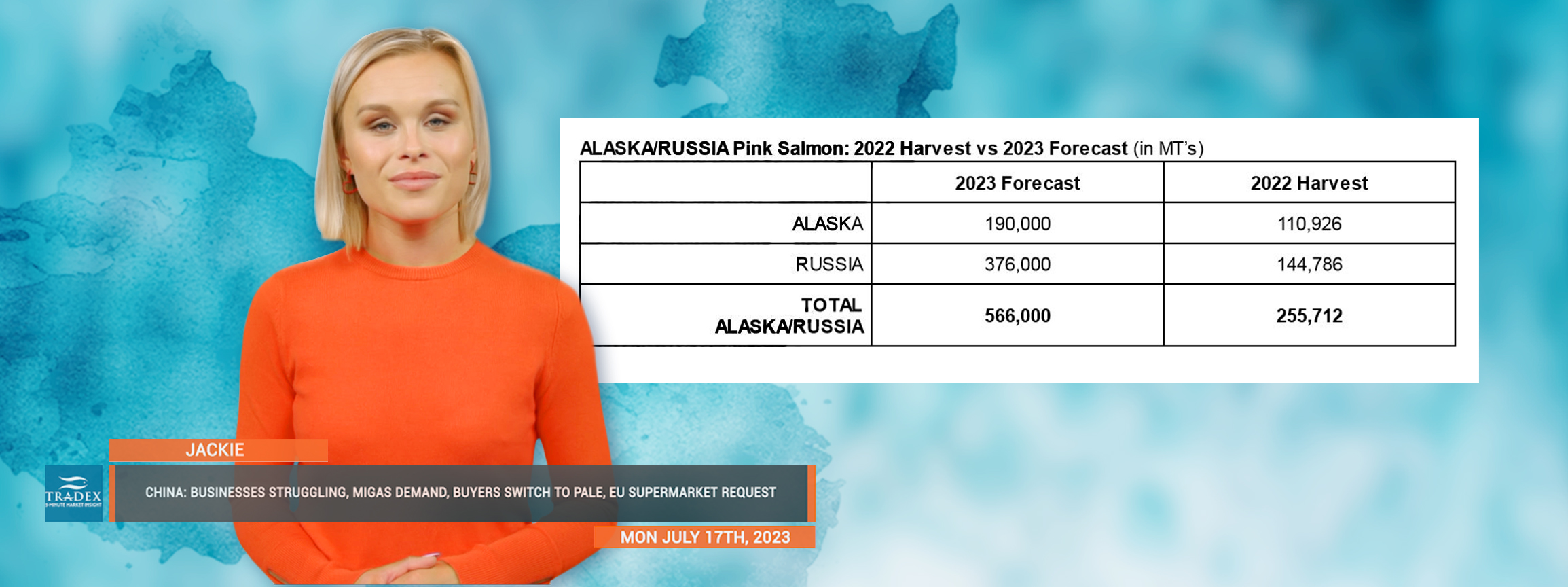

Pink Salmon harvest volumes (by weight) in the U.S. and Russia are estimated to be 120 percent higher than last year if the forecasts are met.

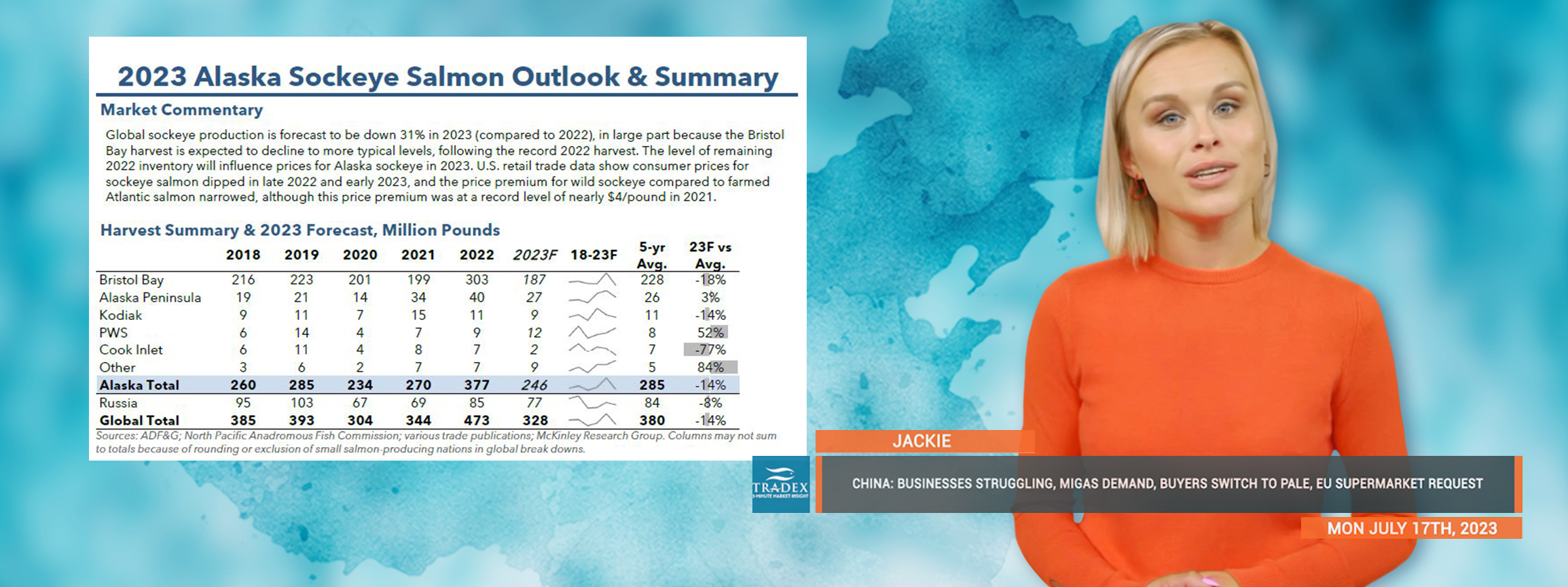

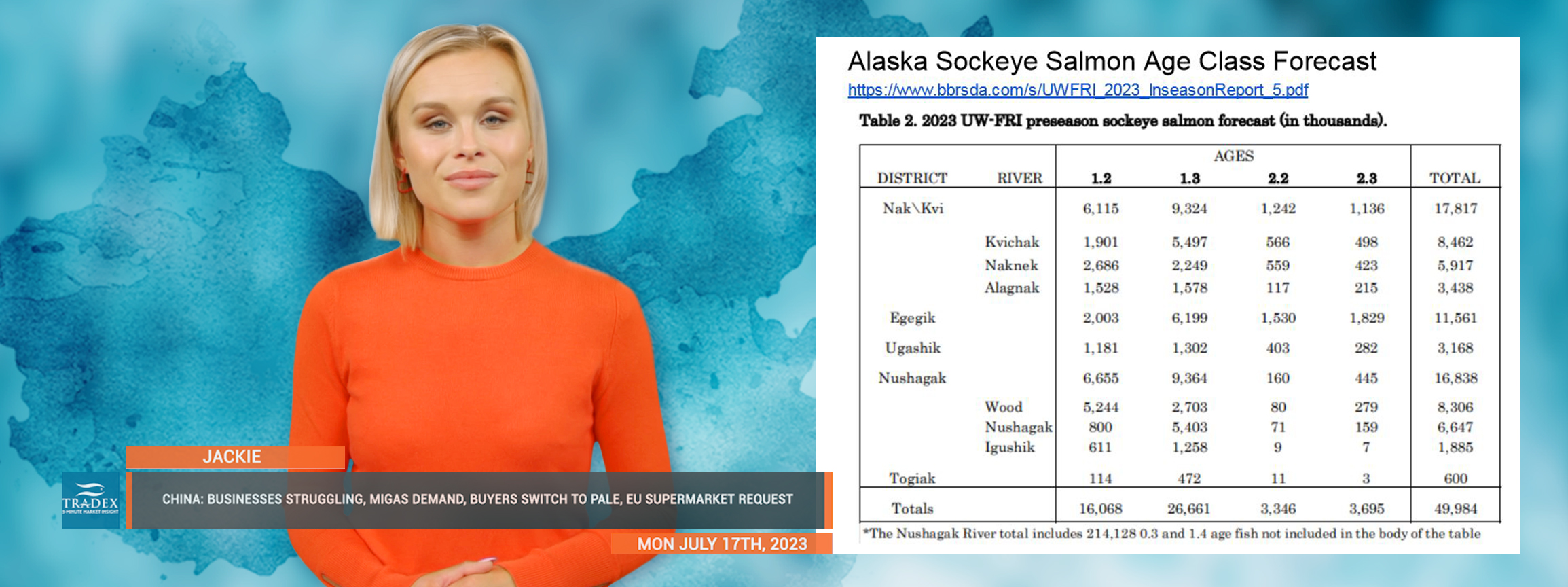

And with global Sockeye harvest (in number of fish) forecast to be down 31 percent from last year, Chinese plants are predicting strong pricing.

Although Sockeye (in number of fish) is anticipated to be down, latest data from the Test Fishery is suggesting Sockeye will be bigger fish - specifically “three-ocean” fish pushing 6 lbs will be the majority of the catch in Bristol Bay.

Our recommendation is to connect with your Tradex Foods rep to discuss your Asia production opportunities.

There should be some tremendous processing opportunities out of China as we cross over the midway mark for 2023.

--- If you are not already, be sure to subscribe to our Weekly Seafood News Update using the signup form below.