Loading

EP 656 | AIRED 09/04/2023

China Update: Salmon Prices, Cod Supply, EU Sales, Freight Costs

Sept 4th, 2023 - The recent concurrent seafood shows in Shanghai and Japan highlighted a higher turnout in Shanghai, driven by the thriving domestic market, in contrast to the Japanese event which experienced lower-than-expected attendance.

In an interesting development, Chinese plants have been receiving a growing number of quotes, possibly due to some plants accepting orders below cost to maintain their production and cash flow.

The salmon market has witnessed a consistent decline in prices, prompting Chinese plants to continually adjust their finished product pricing.

Simultaneously, sluggish sales to the EU and North America have led Chinese plants to curb their purchases despite ongoing inquiries from EU supermarkets, yet lacking confirmed orders.

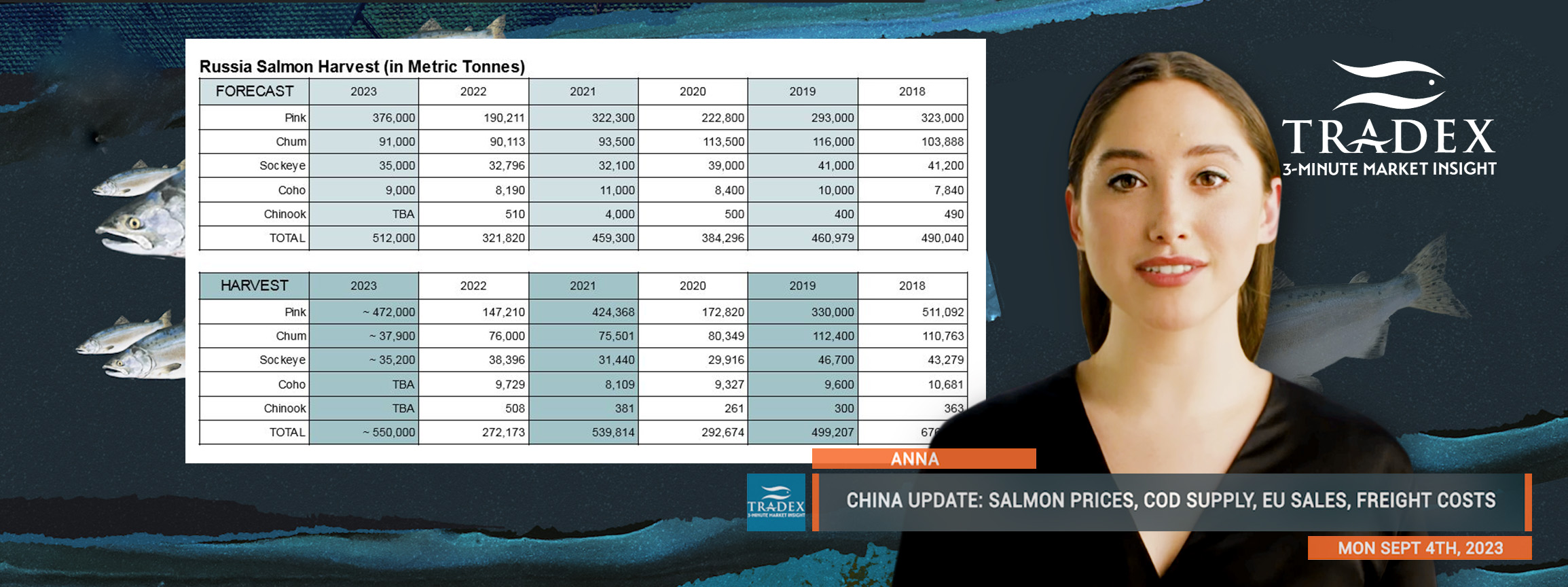

A significant shift in raw material pricing for Russian Pink Salmon has occurred, dropping from $4,500 per metric tonne last year to under $2,000, surpassing the decline observed in 2008.

Additionally, Russia's Pink Salmon harvest has exceeded preseason forecasts by nearly 100,000 metric tonnes, contributing to a total Russian salmon harvest exceeding 550,000 metric tonnes – the highest since 2018.

Turning to Alaska, the peak of the Pink Salmon run seems to have passed, with over 130 million Pink Salmon already harvested, surpassing preseason expectations.

Meanwhile, Chinese Salmon packers are grappling with substantial losses this season, compounded by the necessity to sell at prices below cost to clear their inventories.

The Atlantic Cod supply remains restricted, characterized by a significant $1,000 price differential between Russian and Norwegian catches.

Advertise Here: advertising@tradexfoods.com

The shortfall in Chinese plants' supply can be attributed to reports of Norwegian A. Cod being diverted for processing in the EU and North America.

Freight expenses have exhibited a gradual increase since June, with shipping companies predicting a potential stabilization in October.

Looking ahead, an upswing in volume is anticipated before the Chinese New Year in early 2024, prompting discussions about adding shifts from October to January.

However, container bookings might remain limited until a more pronounced market recovery is witnessed, prompting shipping companies to expand shifts.

As the summer Salmon season winds down, we recommend considering Chinese New Year requirements and implications.

--- If you are not already, be sure to subscribe to our Weekly Seafood News Update using the signup form below.