Loading

EP 674 | AIRED 01/22/2024

Raw Materials Prices Update: China, Russia, Pollock, Cod, Salmon

Jan 22nd, 2024 - Freight costs to the US remain robust, however transitioning into the post Chinese New Year period, industry insiders anticipate a softening in freight rates.

This predicted change is largely due to a decrease in shipping volumes post Chinese New Year, especially in contrast to the high activity seen in the early weeks of January.

Shifting focus to commodity specifics, Chinese processing plants are actively trying to get Russian Pollock prices down to $900 per metric tonne and lower.

Russian suppliers however, are maintaining a firm stance with a price point of about $1,000.

With the Russian Pollock catching season at its midpoint and under the shadow of potential further sanctions, there's speculation that prices might dip below $1,000.

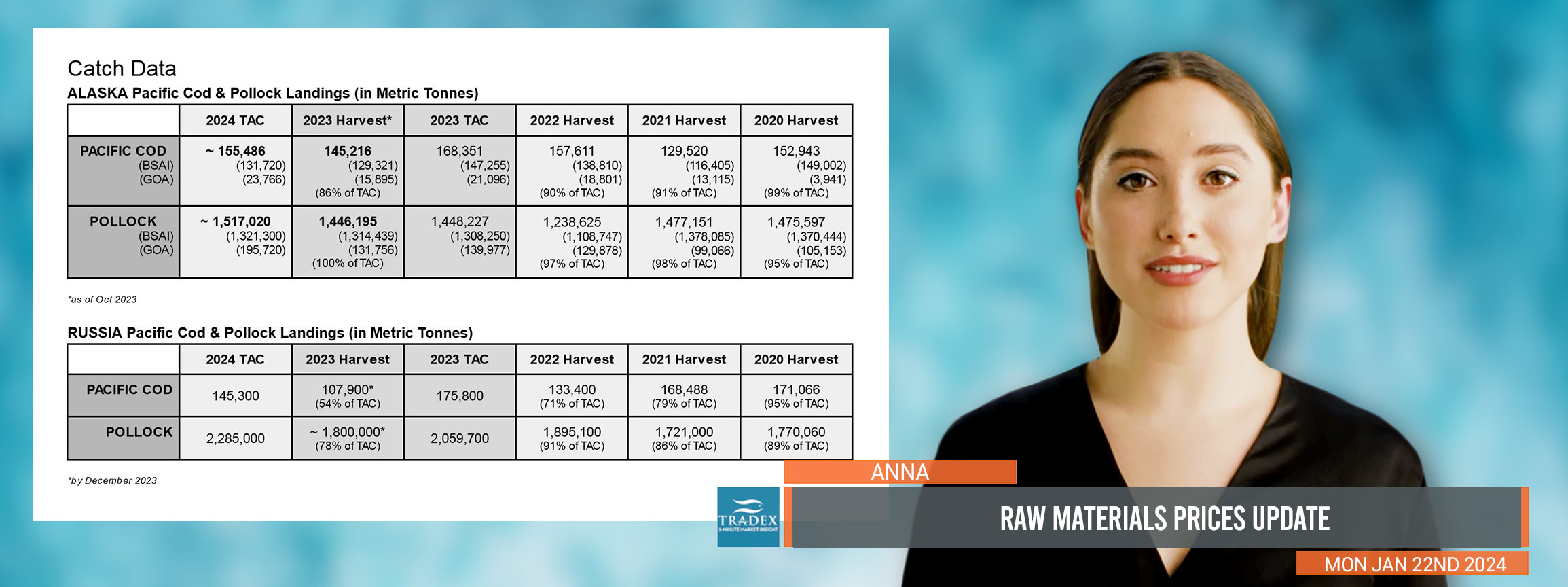

Moving over to Alaskan waters, Alaska's 2023 Pollock catch amounted to approximately 1.4 million tons, predominantly absorbed by the domestic market.

On January 18th 2024, the Biden Administration closed a loophole to the original December 22nd Russian-origin Pollock blocking Executive Order by adding more Russian Pollock HTS codes to block from entering the US.

With that, a significant volume is anticipated to be redirected to China, potentially escalating prices beyond the $2,000 per metric tonne mark.

As we navigate further into the seafood sector, Alaska’s Cod season is on the horizon, and there is a notable push from fishing entities to hike prices for Chinese processors.

Advertise Here: advertising@tradexfoods.com

However, the adoption of these increased costs hinges on the acceptance from end consumers, emphasizing that any trade policy alterations will ultimately reflect in the pricing borne by the final buyers.

Moreover, the Norwegian Atlantic Cod market is witnessing a price surge, with current rates at $4,500 per metric tonne and predictions of exceeding $5,000 post Chinese New Year, influenced significantly by US trade policy shifts.

Finally, zooming into the Salmon market, particularly Chum Salmon, is experiencing a notable price increase in response to new US trade policy changes and is expected to continue post-Chinese New Year.

Additionally, pricing for both Alaskan and Russian Pink Salmon are also on the rise, currently hovering around the $2,400 and $2,100 mark respectively.

Our recommendation is that you secure your supply now through Lent as imminent price increases are expected on most major seafood categories.

With freight rates predicted to soften post Chinese New Year and the speculative dip in Pollock prices, there may be a short window for advantageous deals.

--- If you are not already, be sure to subscribe to our Weekly Seafood News Update using the signup form below.