Loading

EP 689 | AIRED 05/06/2024

China Update: Supply, Prices, Production Strategies, Regulatory Frameworks

May 6th, 2024 - China’s seafood production market continues to experience dynamic shifts in supply, production strategies, and regulations, as global buyers and suppliers adapt to evolving pricing realities and supply chain changes.

Here is an update on the key developments since our last China report in early March.

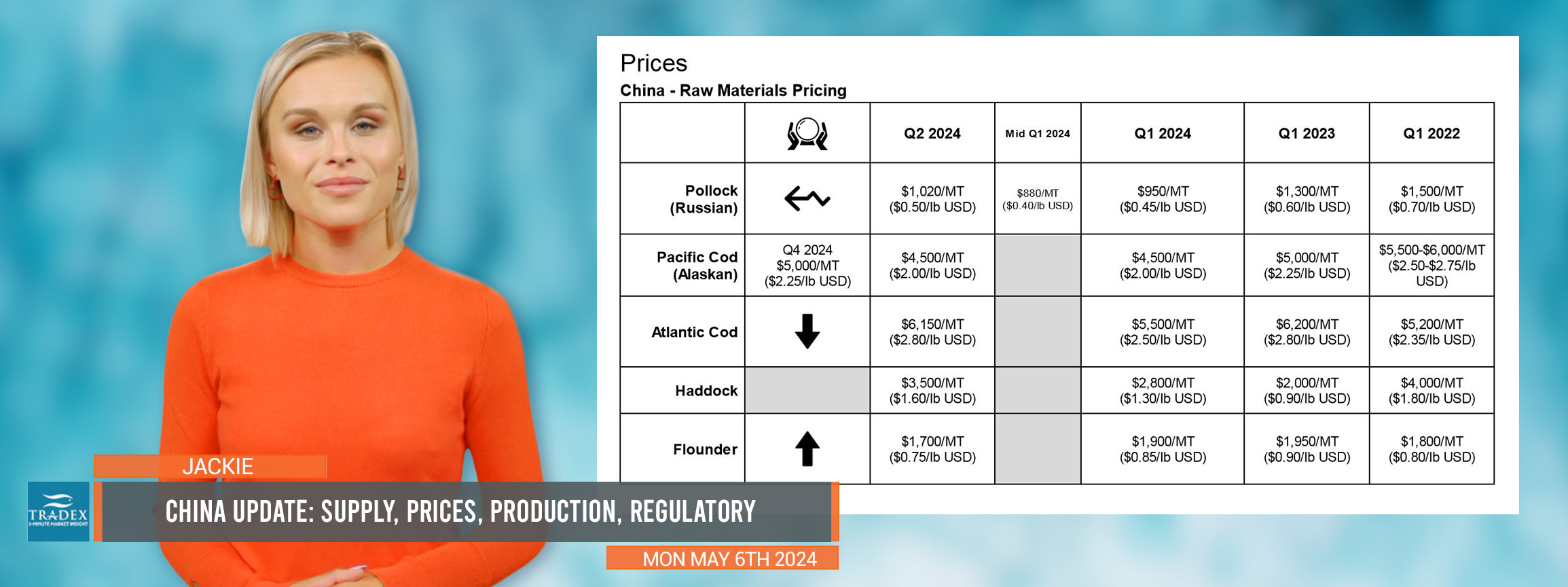

The Pollock market has experienced notable fluctuations recently. Following the U.S. ban on Russian fish, prices momentarily dropped to $880 per metric tonne before some plants capitalized on this by stocking up.

Prices have since stabilized at $1,020 per metric tonne, driven by strong demand from EU buyers mainly for finished products, fillets, and blocks.

This stabilization occurs after a period where prices hovered around $950, down from the previous year’s $1,300.

The Alaskan Cod market has seen rising prices due to limited supply and increased demand. Suppliers are prioritizing long-term partners, with prices expected to reach up to $5,000 per metric tonne before the next Chinese New Year break, up from recent levels around $4,700 for smaller sizes.

Haddock prices have risen significantly, with Norwegian Haddock now priced at $3,500 per metric tonne, up from $2,800 in March and $2,000 in December.

Advertise Here: advertising@tradexfoods.com

Catch volumes in Iceland, Norway, and Russia are steady, with projections on track to meet annual expectations.

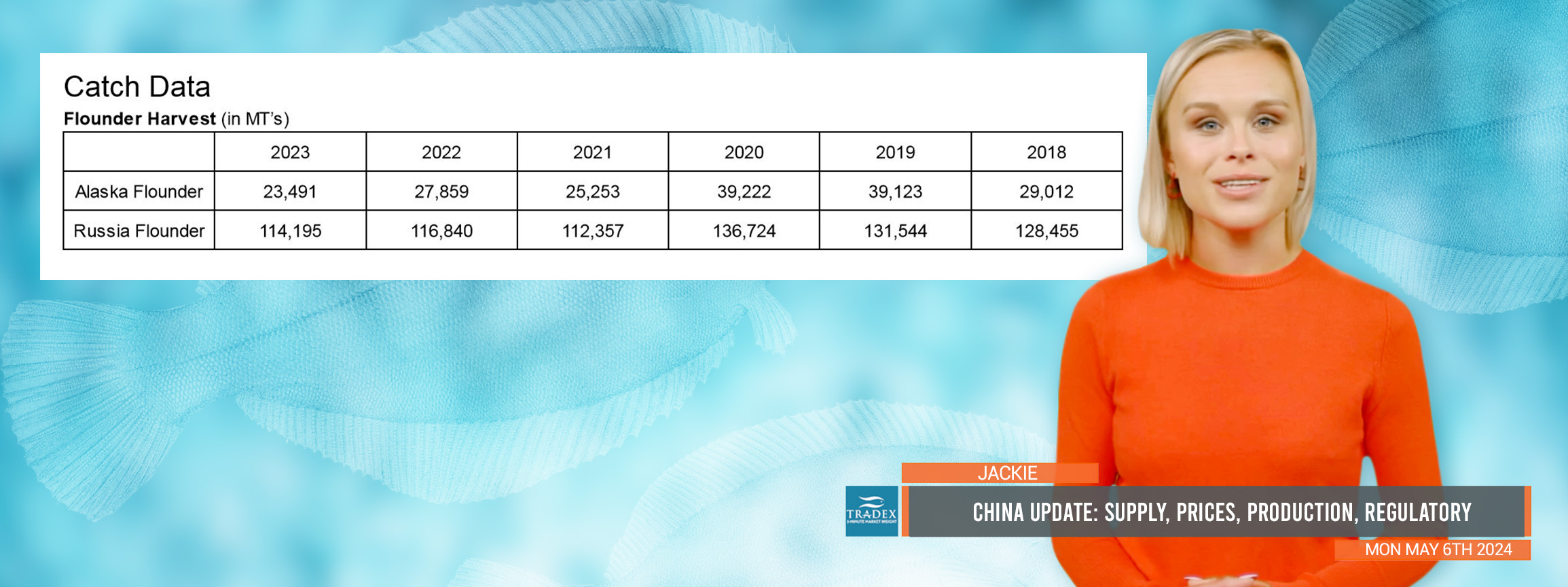

Flounder prices have decreased from $1,900 in December to $1,700 currently, but are expected to rise back due to a significant drop in catch volumes—only 40% of last year's already low figures.

Efforts to diversify production to Vietnam and Indonesia have had mixed results. While these regions can efficiently process simpler products like cod and salmon fillets, they face challenges with more complex items such as small flounder fillets, which are still more costly and less efficient than in China.

Logistics continue to evolve, with shipping companies reducing routes to Boston due to declining outbound volumes, leading to higher operational costs and likely impending freight cost increases.

Our recommendation with the current market conditions is that securing inventory at reasonable prices could reduce risks associated with further price escalations as the year progresses.

--- If you are not already, be sure to subscribe to our Weekly Seafood News Update using the signup form below.