Loading

EP 501 | AIRED 08/17/2020

Current State of Sockeye & Chum Salmon Market

August 17, 2020 In this week's episode, we narrow in on the current state of the market for Sockeye and Chum Salmon.

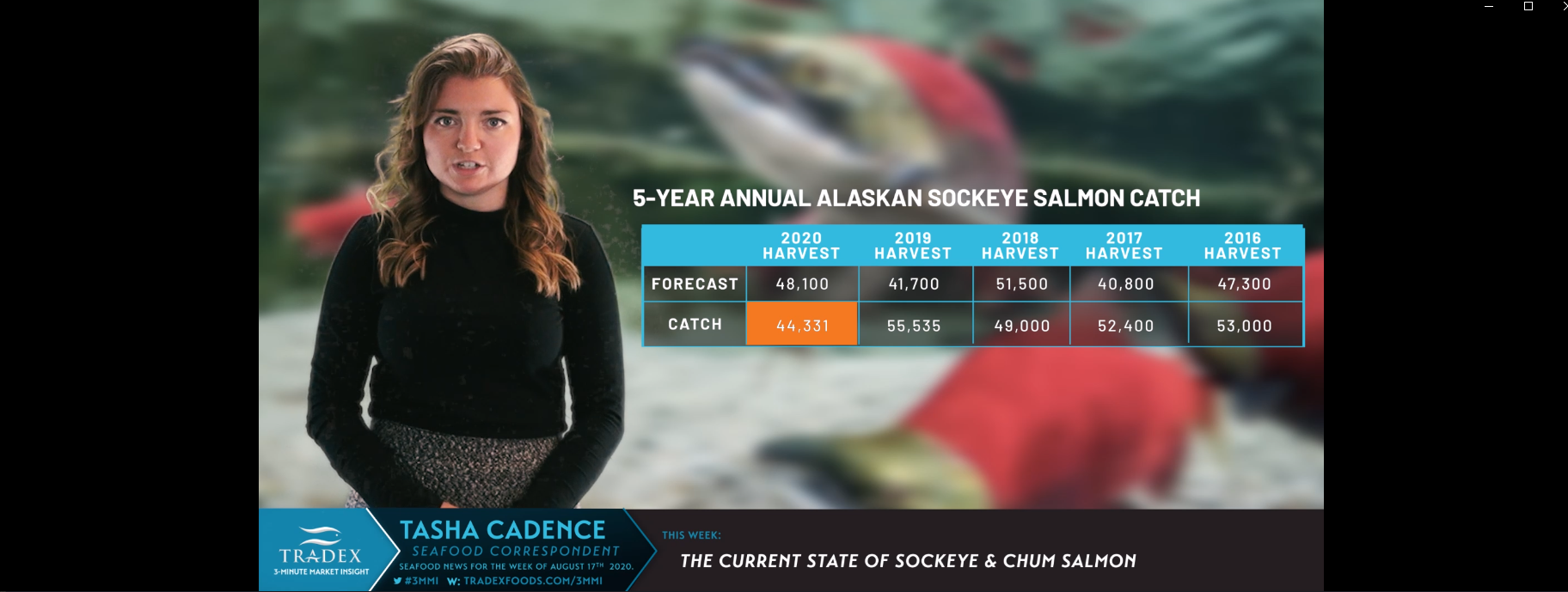

--- As Alaska's Sockeye season winds down, fishermen were able to bring in over 44 million fish - a level similar to the long-term average.

However, as we report this, once-frozen Sockeye fillets continue to be in very limited supply and pricing is significantly higher than last year

Moving on, 2-4lb H&G Sockeye's are in high demand and extremely hard to source.

As well, it appears that inventories of 4-6lb H&G's are limited and we were advised that pricing is to lead an upward trend.

So the question is, with such an impressive 2020 harvest of Alaskan Sockeye, where did all the inventories go?

Seafoodnews.com recently reported that "seafood was the fastest growing supermarket category during the last week of May."

"Multiple reports over the last few months have explained how overall seafood purchasing at supermarkets and other stores have set new records. And according to Nielsen, that trend has not slowed down."

Nation's Restaurant News recently reported as well that "Increases in meat and poultry prices have allowed restaurants to use fish and shellfish as the base for menu creativity."

--- As the COVID-19 pandemic interrupted foodservice, that forced consumers to rediscover their stovetops and ovens and begin preparing seafood at home.

Infact, contrary to popualr belief that seafood is mostly consumed in restaurants, a new paper out in June (Food Sources and Expenditures for Seafood in the United States; Love et al), revealed that when measuring by weight, the majority of seafood is eaten in-home.

Although when measuring by dollars-spent, most money spent on seafood happens at restaurants.

This paper was based on pre-pandemic statistics in the US and having a pre-pandemic baseline should be very useful for the industry moving forward.

Although retail demand for Salmon has spiked throughout the pandemic, we still cannot undercut the amount of seafood demand driven by foodservice sales, and that those sales have yet to match pre-covid levels.

--- Fresh intel to Tradex is also showing the most sought after restaurant foods right now are seafood and Mexican food, and that dining restaurants are recovering better than other foodservice establishments.

To this end, we don't believe retail sales are the main driver for the limited availability of Sockeye, rather that current inventories are presently waiting in freezers.

Our recommendation for Sockeye buyers is similar to a few weeks ago - which is to secure your supply now.

Sockeye prices are anticipated to make a good bull-run before moving into a bear-type market.

As reported in our last Salmon update, we would not count on much Sockeye supply to come out of Canada's B.C. Salmon fishery again this year, and Russia's Salmon fishery is also expecting a smaller run this year.

--- Moving on to the current Chum Salmon Market, here's our recommendation;

Chum Salmon buyers need to make moves now - and if you need this fish, Buy It Now.

Alaska's Chum Salmon season is being described as disastrous.

As reported on ASMI's Salmon Harvest Update #9, "year-to-date keta harvest totals 4.7 million fish, about ten million fewer than the 5-year average. Production has been particularly slow in the Arctic-Yukon-Kuskokwim and Southeast region. Kodiak was down about 20 percent from the 2019 pace and the Prince William Sound Area was 36 percent behind."

In Washington, the 2019 Chum Salmon fishery saw only 287,000 Chums harvested compared to previous years where the state catch typically sees about about a million fish - fishery managers have already warned of another tough year.

In Russia, 36.6 million Chums were harvested in 2019 and the catch for 2020 is forecasted to come in lighter than the previous.

--- And lastly, just a quick note on the Salmon situation in Asia.

In speaking to our VP of Asia Operations, he advised they are anticipating that New Season Chum won’t be available until the end of September and that Salmon will certainly be very short this year.

Both from Russia and Alaska, where Alaska fish will be shorter and the estimated raw materials price will go up to $4300 per metric tonne - which translates to about $1.95 to $2.00/lb USD.

--- Check out our Salmon Buyer's Update from August 3, 2020 for the full coverage on All Pacific Wild Salmon.