Loading

EP 508 | AIRED 10/05/2020

Pacific Halibut Update: Canada, USA, Russia & China

October 5th, 2020 --- This week we report on Pacific Halibut from Canada and the USA to China Processed Russian Halibut and how prices may have hit the bottom but are on their way back up.

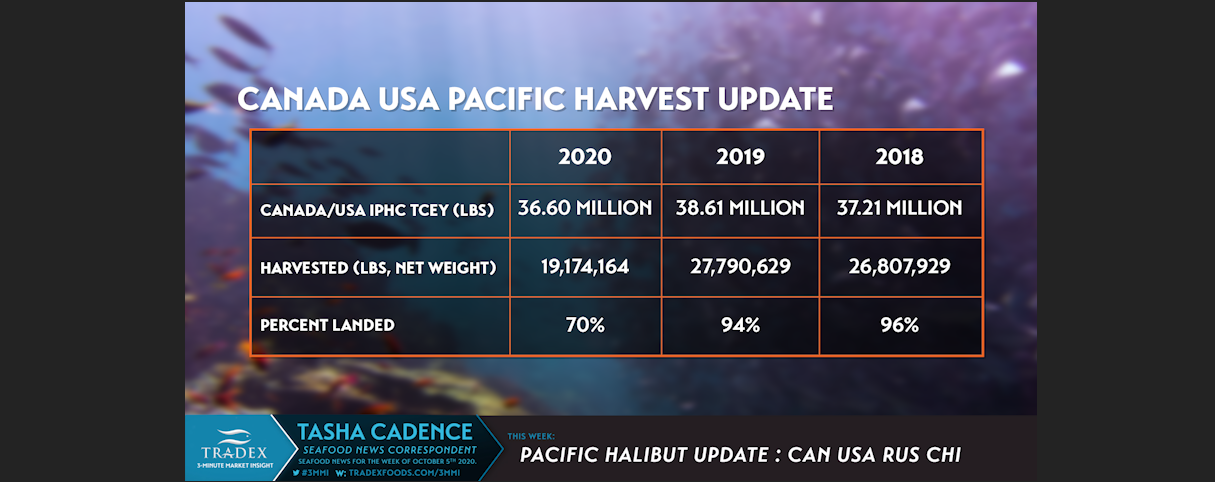

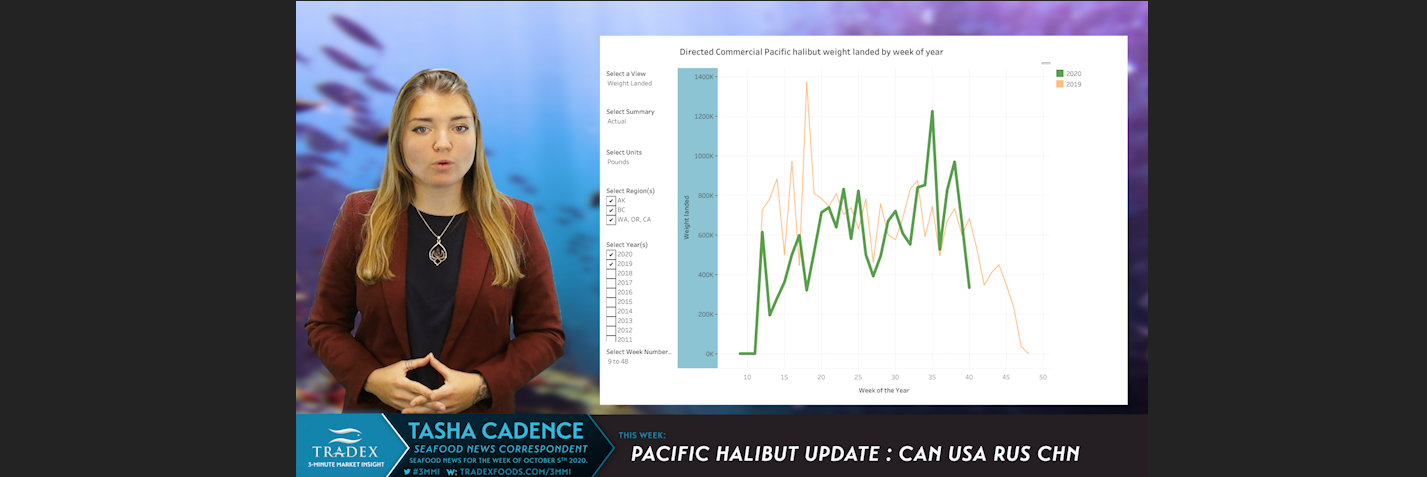

With about a month and a half left in the Canada/US Pacific Halibut Fishery, fishermen have managed to harvest just over 19 million pounds.

Despite the COVID-19 Pandemic, the current pace is now only behind about 425,000 pounds compared to the same time last year.With most of the fishery ending November 15th, about 1.2 million lbs would need to be harvested per week to match the same pace as previous years.

The Canadian fishery (Area 2B) had it's season extended to December 7th by The International Pacific Halibut Commission in a response to COVID-19 disruptions to fishing opportunities and markets.

Halibut pricing for much of 2020 has been lower than 2019 mostly caused by the COVID-19 pandemic putting a strain on dine-in foodservice as Halibut is traditionally consumed at white-tablecloth establishments.

Adding to the strain, an article published on May 12th in Anchorage Daily News reported that Russian and Canadian Halibut were flooding the US markets with their lower priced Halibut.

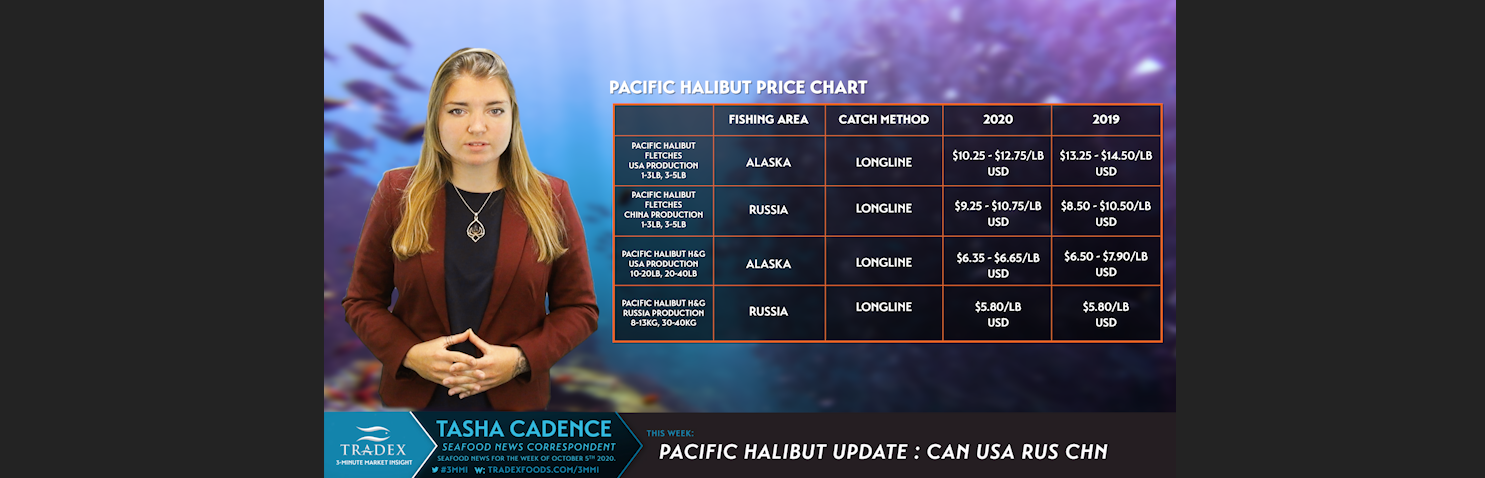

--- Data off our TradexLIVE portal shows new season Alaskan Longline Halibut Fletches between $10.25 to $12.75/lb USD this year compared to $13.25 to $14.50/lb in 2019.

On the contrary, Twice Frozen Russian Longline Pacific Halibut Fletches produced in China have been priced slightly higher on average most of this year hovering between $9.25 to $10.75/lb USD compared to $8.50 to $10.50/lb in 2019.

On the commodity side, new season Headed and Gutted Alaskan Longline Halibut saw pricing between $6.35 to $6.65/lb USD this year compared to $6.50 to $7.90/lb in 2019.

Despite lower foodservice sales, consumer data showed a slight uptick in retail sales of Halibut as consumers took to their kitchens to get their Halibut fix.

Instead of Halibut inventories going straight to freezers, fresh sales were moving and most of the industry saw hand to mouth production and sales.

Our recommendation is to get your Halibut program in order as an upward price trend is anticipated due to more demand from the economical revival of foodservice in the US and the potential for a shortage of Russian Halibut raw materials.

Moving on to Russian Halibut and the Twice Frozen Chinese Production.

In China, prices on Pacific Halibut have been at a low levels over the last year, however prices have recently started an upwards movement as vendors are reporting that North American buyers have started buying again.

The upwards price trend is also being anticipated due to a shortage in supply of Russian Halibut.

It is being reported that some Russian boats are not harvesting Halibut due to raw materials prices currently at around 40 percent of what boats were receiving 2 years ago.

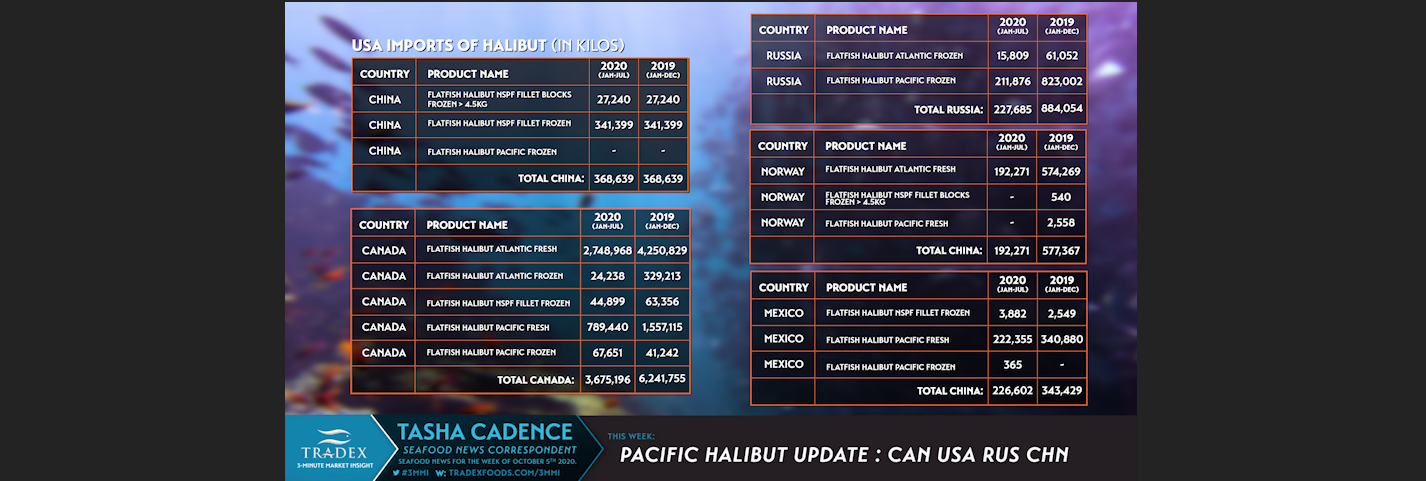

In 2019, US imports of Pacific and Atlantic Halibut totalled 884,054 Kilos (or 1.9 million lbs) directly from Russia and 757,539 Kilos (or 1.7 million lbs) from China.

Compare this to January to July 2020, US imports of Halibut total 227,685 Kilos (or 500,000 lbs) from Russia and 368,639 Kilos (or 800,000 lbs) from China.

As Russian Halibut is mostly caught as bycatch the harvest data is limited.

However since Halibut is not typically consumed in Russia nor China, and Chinese production mostly uses Russian fish, and almost all Russian and China Halibut production is targeted for the North American market - we can use the above import data to get a sense of how much Russian Halibut is harvested.

--- If you are not already, be sure to subscribe to our 3-Minute Market Insight using the signup form below - to keep tuned into all out upcoming market insights.