Loading

EP 004 | AIRED 06/30/2025

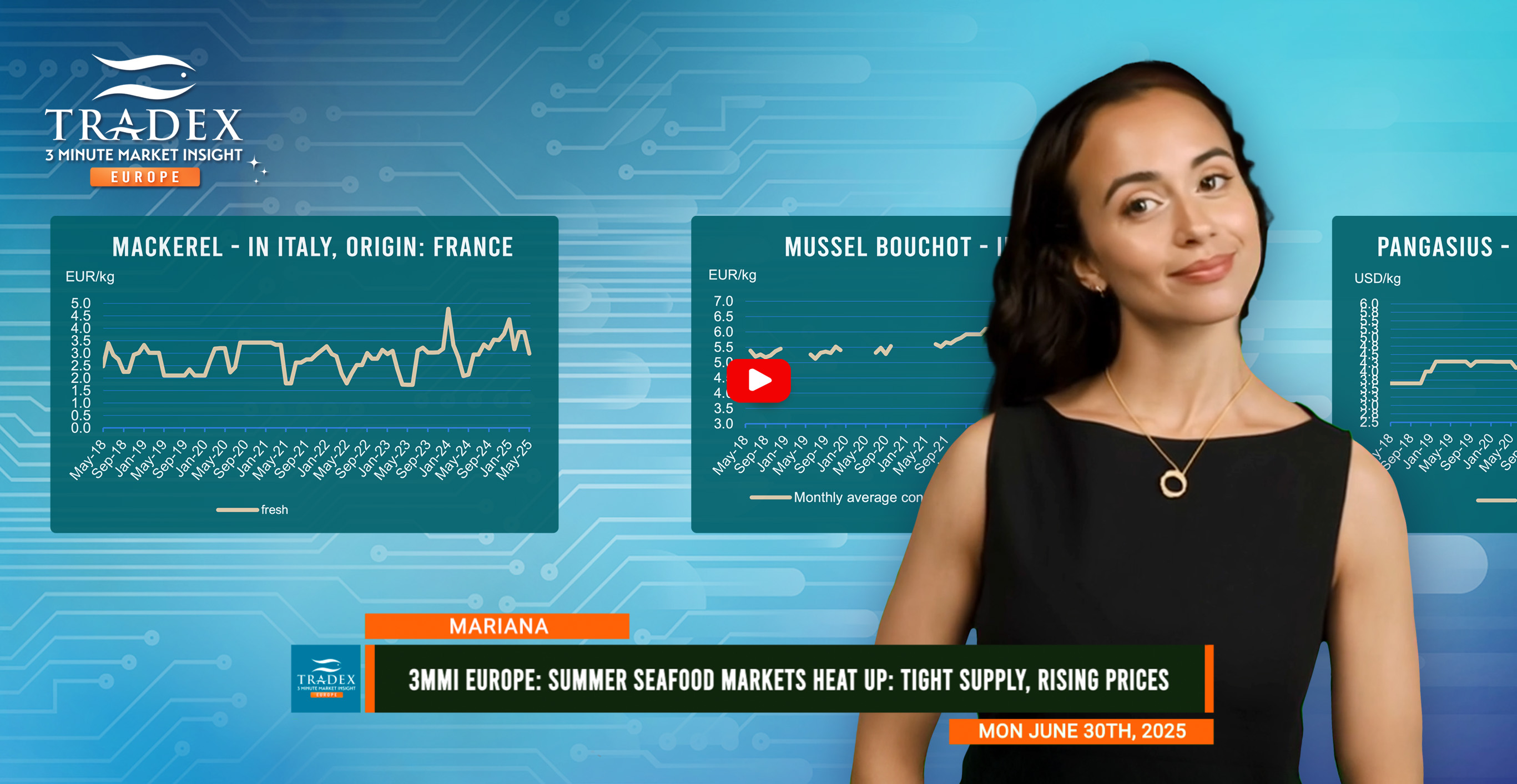

Rising Prices and Shifting Flows: EU Buyers Face Tight Summer Seafood Market

June 30th, 2025 - As the summer season approaches, Europe’s seafood markets are entering a phase of tightening supply, intensifying demand, and a notable upward trend in prices across many key species, driven by global supply constraints and growing seasonal consumption, particularly in Southern Europe.

Seafood prices are climbing, with 23% of tracked products (such as cod fillets, tuna loins, frozen shrimp, and seabream) showing increases over the past month. Fresh cod fillets reached upwards of €16.50/kg, and Spanish hake rose by as much as €2.00/kg, driven by stronger retail and foodservice demand. These gains reflect tightening global supply caused by quota cuts, environmental pressures, and seasonal closures, just as Mediterranean markets enter peak tourist season, further fueling consumption.

Trade uncertainties are impacting supply flows, with new U.S. tariff risks on shrimp and trout prompting many Asian exporters to shift product toward Europe. In response, European processors—particularly in Spain, Italy, and France—are increasing imports of frozen and semi-processed items like tuna loins and pangasius to offset fresh supply instability. In 2024, the EU imported over 700,000 tonnes of semi-processed tuna worth USD 4.21 billion, up 10% year-over-year, with Spain and Italy as key importers.

Whitefish prices remain high, with cod firm on reduced quotas and hake rising sharply in Spain. Pangasius from Vietnam, priced at €2.50–€3.50/kg, softened slightly despite a 5% rise in UK Q1 imports, indicating weak retail demand. In contrast, tuna prices are stable, with skipjack and yellowfin loins trading between €5.00–€7.70/kg and steady buyer interest.

In the salmonid category, Norwegian salmon exports reached over 100,000 tonnes in April, valued at NOK 10 billion (or 837 million euros), though average prices dropped 29% year-over-year to €7.08/kg, creating strong buying opportunities. Trout exports rose 53%, with prices rebounding after earlier declines, now at €6.86/kg FOB.

Advertise Here: advertising@tradexfoods.com

Shellfish markets are mixed: shrimp prices remain stable, though buyers are wary due to Argentina’s delayed season and potential U.S. tariff changes. Italian clam prices hit a record €17.50/kg amid blue crab disruption. South African squid supply is tight with the fishery closed until late June, pushing prices to €5.00 to €7.50/kg; South America is expected to help fill the shortfall.

Meanwhile, seabass and seabream prices have risen to €6.00 to €11.00/kg with growing summer demand. Türkiye is expanding its market share in key destinations like Greece, Italy, and the UK, solidifying its position as a key supplier of farmed Mediterranean species.

Looking ahead, our recommendation is buyers are advised to act early on frozen and value-added products, particularly tuna, shrimp, and pangasius. Falling salmon prices offer good buying opportunities, while volatility in clams, squid, and wild cod calls for cautious sourcing strategies.

With Mediterranean demand rising and global trade flows in flux, staying ahead of tariff developments and diversifying suppliers—especially for farmed species—will be key to maintaining margins through the summer.

--- If you’re not already, be sure to subscribe to our Europe 3-Minute Market Insight to keep tuned-in to European market updates.