Loading

EP 005 | AIRED 07/07/2025

Shrimp, Squid, and Whitefish Markets Tighten for EU Buyers

July 7th, 2025 - European seafood buyers are entering the third quarter of 2025 amid a rapidly shifting global landscape. Key product categories - including Argentine shrimp and Peruvian squid - are facing significant supply constraints, while trade realignments and evolving tariff policies add new layers of complexity to procurement planning.

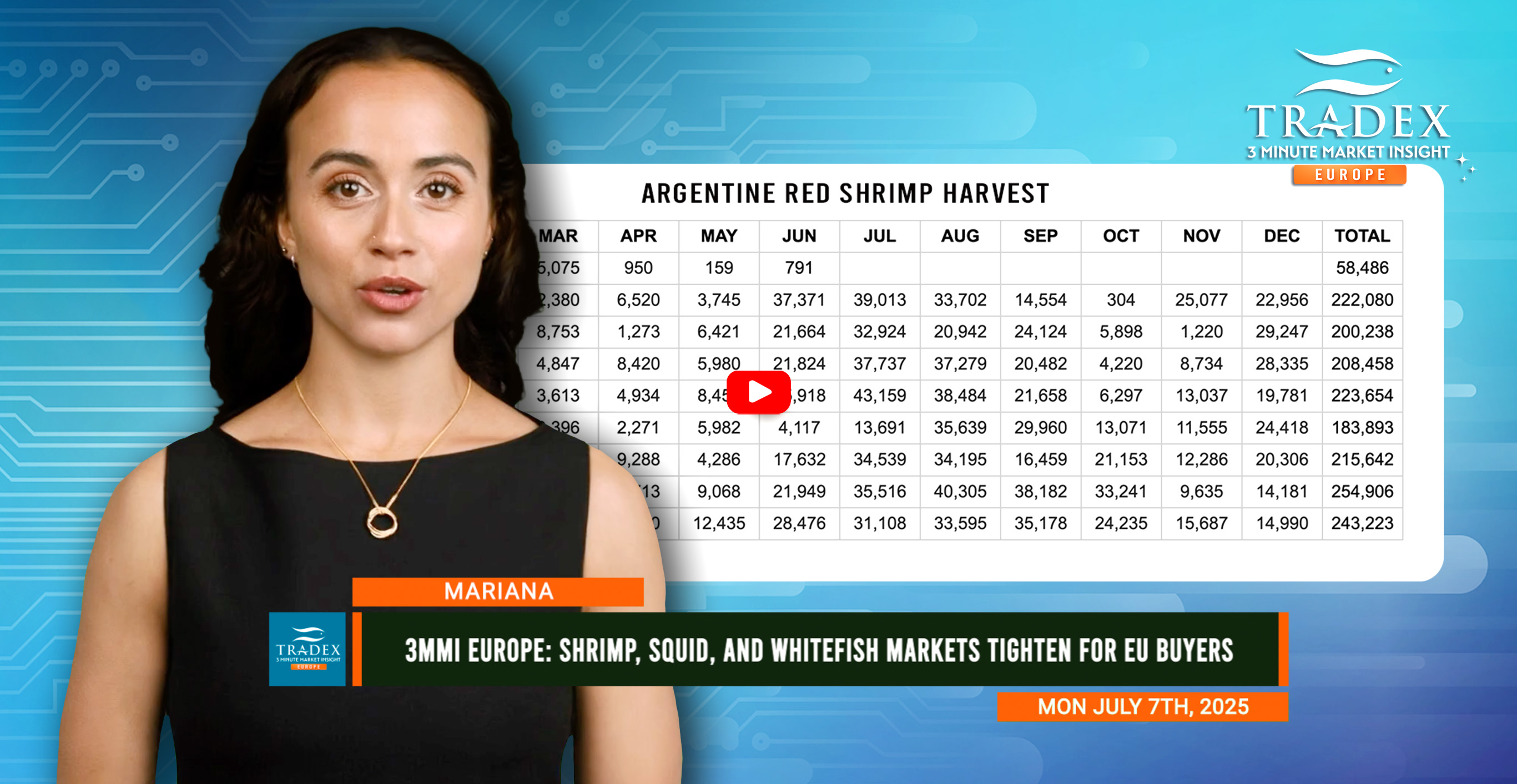

Argentina’s shrimp fishery is facing one of its worst years on record, with landings between April and June collapsing to just 1,900 tonnes - down from over 47,000 tonnes the same time last year - due to labour disputes and economic pressures. Only 60,000 tonnes have been harvested so far in 2025, meaning 23,000 tonnes per month would be needed through December to meet typical annual volumes, a goal that now seems unlikely.

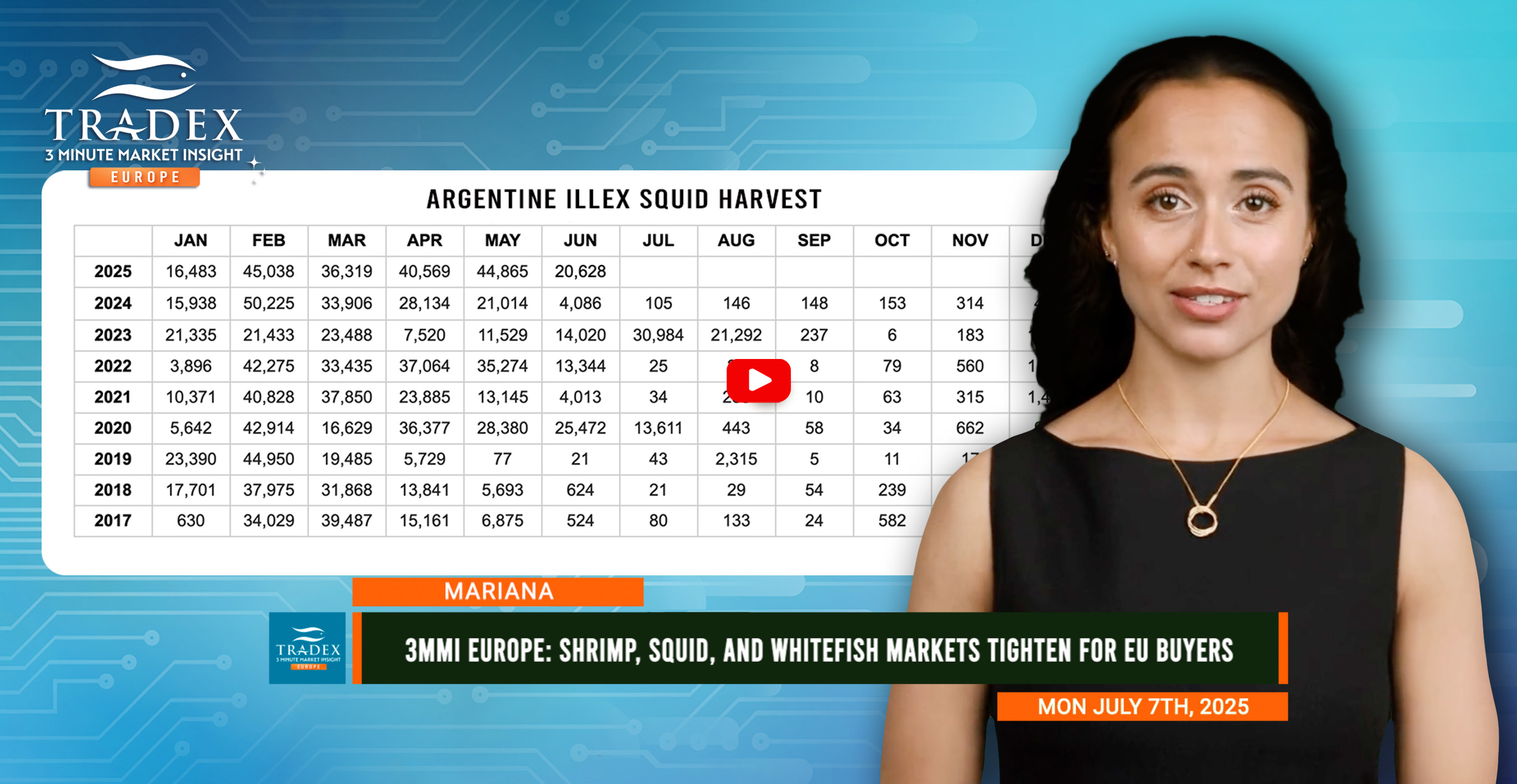

Argentina’s Illex Squid season has provided a short-term buffer, with landings reaching a 28 year high of over 200,000 tonnes. However, rising demand is already pushing prices upward, making early procurement essential for buyers looking to secure volume at stable rates. Meanwhile, Peru squid season has ended two months early, tightening global supply of Dosidicus gigas and increasing pressure on alternative sources.

Russia’s growing trade relationship with China is reshaping seafood export flows, with first quarter 2025 exports to China surpassing $680 million and frozen cod values up 30%. As more Russian-origin whitefish is redirected to the Chinese market, European buyers may face reduced availability of key species like cod and pollock. To maintain supply stability, EU importers should consider diversifying sourcing through countries like Norway, Iceland, or Canada.

The EU and UK have signed a new fisheries agreement extending reciprocal access to shared waters until 2038, bringing long-term stability for key species like herring, mackerel, and scallops. The deal also reduces customs friction, enabling smoother trade between both markets.

Advertise Here: advertising@tradexfoods.com

Meanwhile, despite a temporary pause in U.S. tariffs, trade tensions persist. The potential for new seafood-related duties post-July could affect freight costs and market access, making it essential for EU buyers to monitor U.S. trade developments closely.

Our recommendation is for European seafood buyers to secure Illex Squid and shrimp volumes early, diversify sourcing to manage South American and Russian disruptions, monitor U.S. tariff risks, and leverage improved UK–EU trade conditions for long-term stability.

--- If you’re not already, be sure to subscribe to our Europe 3-Minute Market Insight to keep tuned-in to European market updates.