Loading

EP 006 | AIRED 07/14/2025

Asia–Europe Freight Rates Surge: Red Sea Instability, European Port Congestion, Blank Sailings to Reduce Capacity

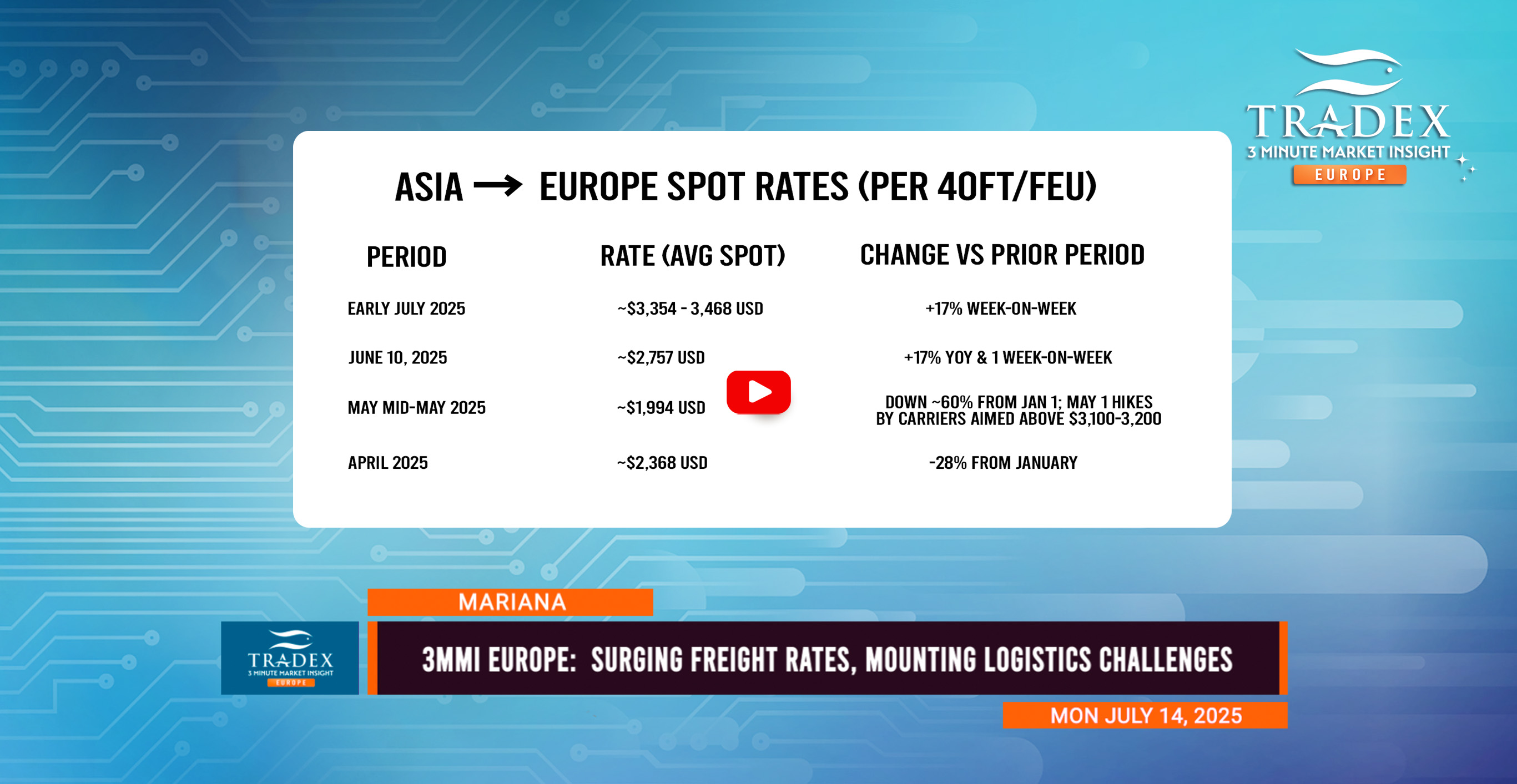

July 14, 2025 - European markets are entering peak summer season amid surging freight rates and mounting logistics challenges. The combined impact of the Red Sea crisis, European port congestion, and reduced carrier capacity has pushed Asia–Europe freight costs to their highest levels in over a year.

Asia–Europe spot rates are surging past key benchmarks - spot rates from Asia to Northern Europe now exceed $3,350 USD per 40-foot container, up nearly 68% since mid-May, and have surpassed rates on the Asia–US lanes for the first time this year.

The surge is driven by rerouting around Africa due to Red Sea instability, adding up to two weeks in transit and significantly increasing shipping costs.

At the same time, congestion at major European ports is further delaying cold chain cargo, while carrier initiated blank sailings and reduced vessel space are keeping rates artificially elevated. Carriers also introduced a June 1 general rate increase above $3,100 USD per container; while not all hikes held initially, ongoing volatility and reduced service have steadily pushed rates toward that level.

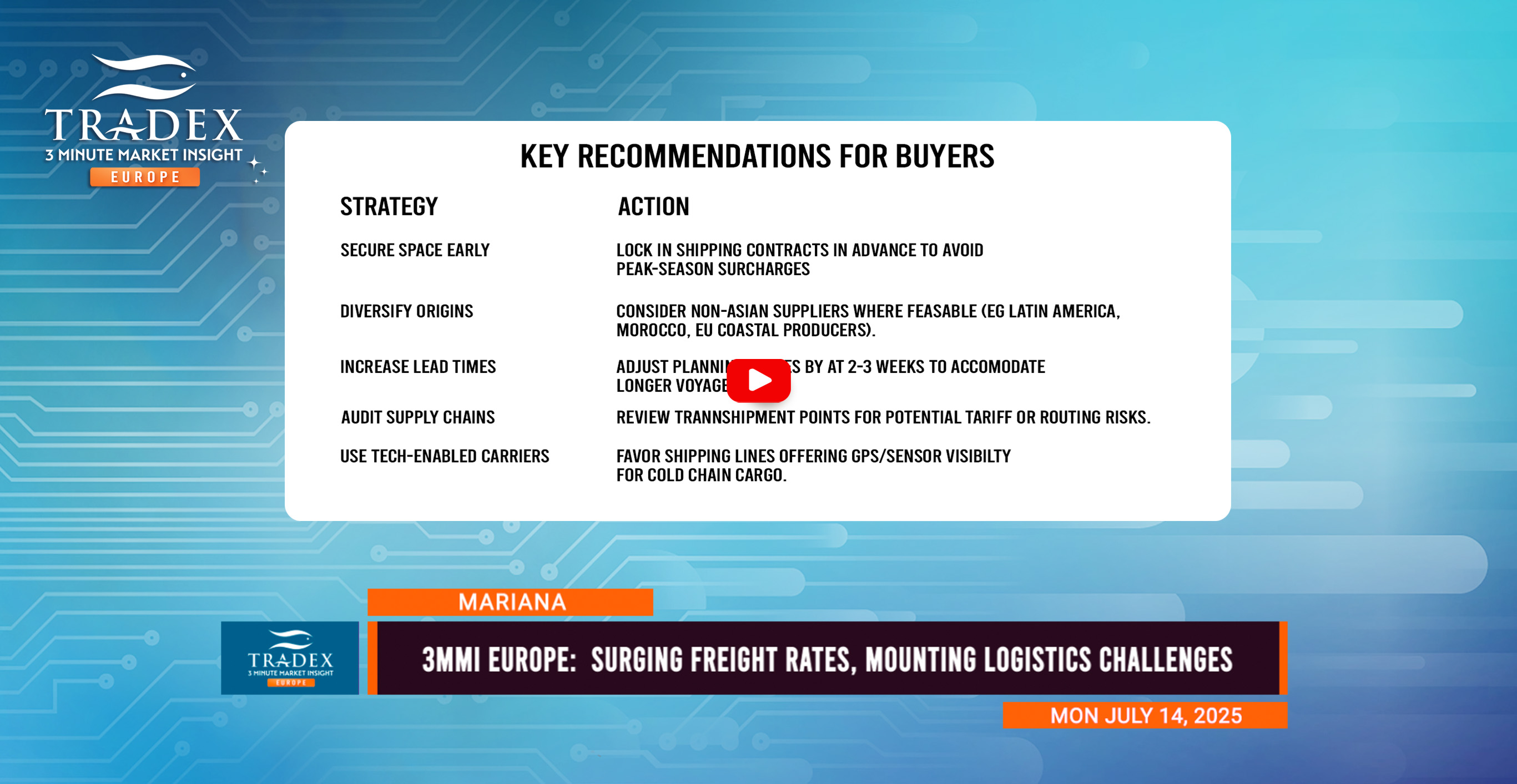

Buyers sourcing from Vietnam, India, China, Indonesia, and Thailand—especially frozen shrimp, squid, pangasius, and tilapia—should expect higher landed costs and potential container shortages. Cold chain reliability may be further strained by limited reefer availability.

Fresh seafood shipments, including tuna, swordfish, and octopus, are also affected, with longer lead times and delays due to bottlenecks at European cold storage facilities. Buyers should consider alternative sourcing where possible.

Advertise Here: advertising@tradexfoods.com

In addition, the end of trans-Atlantic tariff pauses is creating uncertainty for seafood re-exported through the U.S. or U.K.—such as smoked salmon and prepared crab—raising compliance risks due to possible tariff reclassification..

While some carriers like Hapag-Lloyd are introducing sensor-based tracking, visibility gaps and disruptions remain common, especially at port and inland levels during summer peak.

Our recommendation is that buyers secure space early, diversify beyond Asia, extend lead times, audit transshipment routes for tariff exposure, and use carriers with strong tracking capabilities.

Although rates may stabilize later in Q3 if congestion eases, persistent geopolitical risks and seasonal demand will likely keep freight costs elevated—demanding disciplined sourcing, budget flexibility, and tight coordination with logistics partners.

--- If you’re not already, be sure to subscribe to our Europe 3-Minute Market Insight to keep tuned-in to European market updates.