Loading

EP 740 | AIRED 05/12/2025

Europe Seafood Market Update: Tariffs Bite, Supply Tightens, Prices Climb

May 12th, 2025 - Seafood demand surged across Europe in April due to a late Easter, currency swings, and rising trade tensions, creating a fast-changing market for EU buyers.

New U.S. tariffs on seafood from the EU, Canada, and Mexico are pushing exporters to pivot toward Europe, with many seeking buyers at last week’s Barcelona Seafood Show.

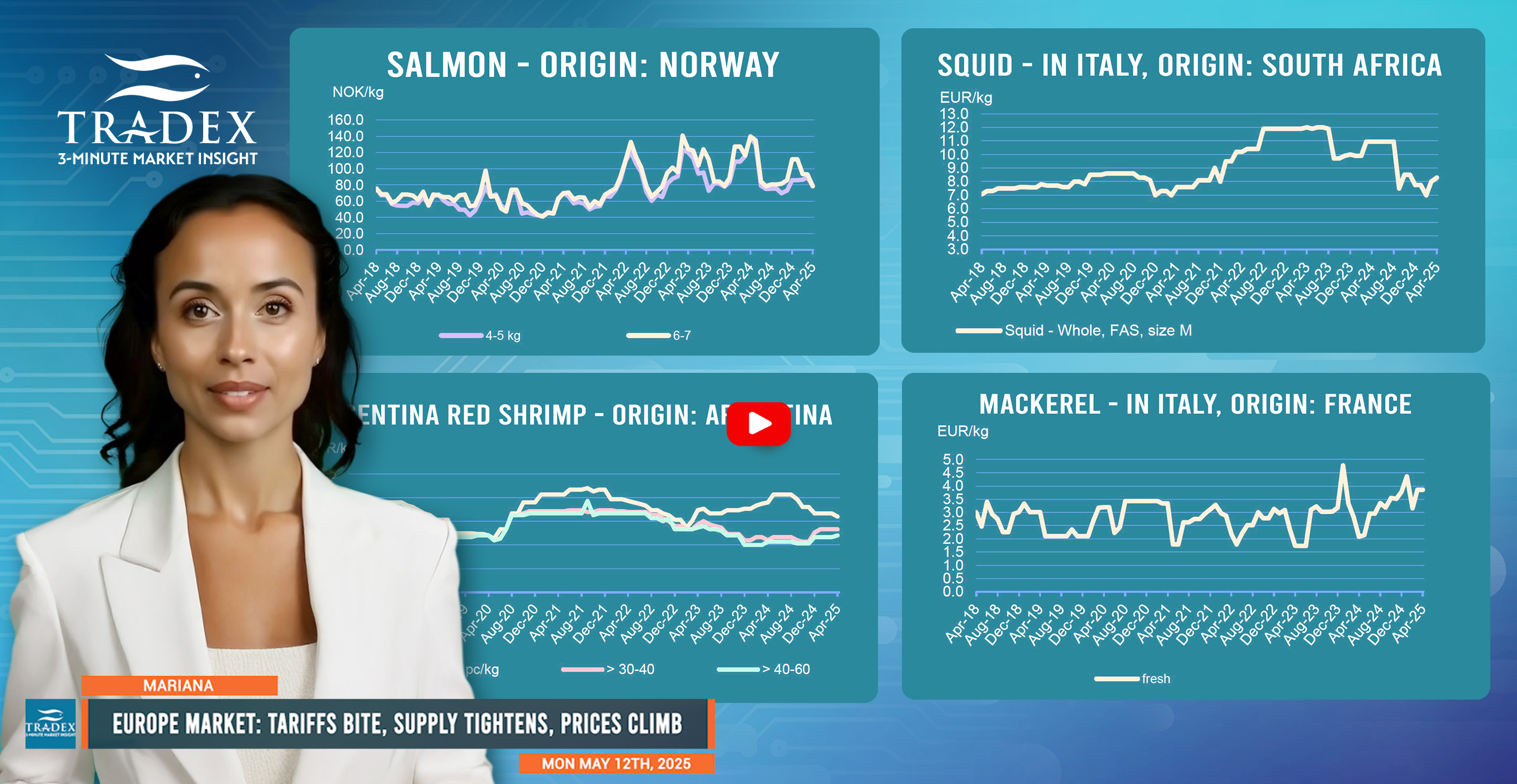

Easter-driven demand has raised prices for cod, octopus, and shrimp, while supply is tightening due to quotas and trade disruptions.

Cod prices remain elevated following a 25% quota cut in Norway, which has tightened supply and fueled competition for raw material. Warmer weather in Southern Europe has softened demand for cured cod outside traditional Easter consumption, but prices are still high due to limited availability.

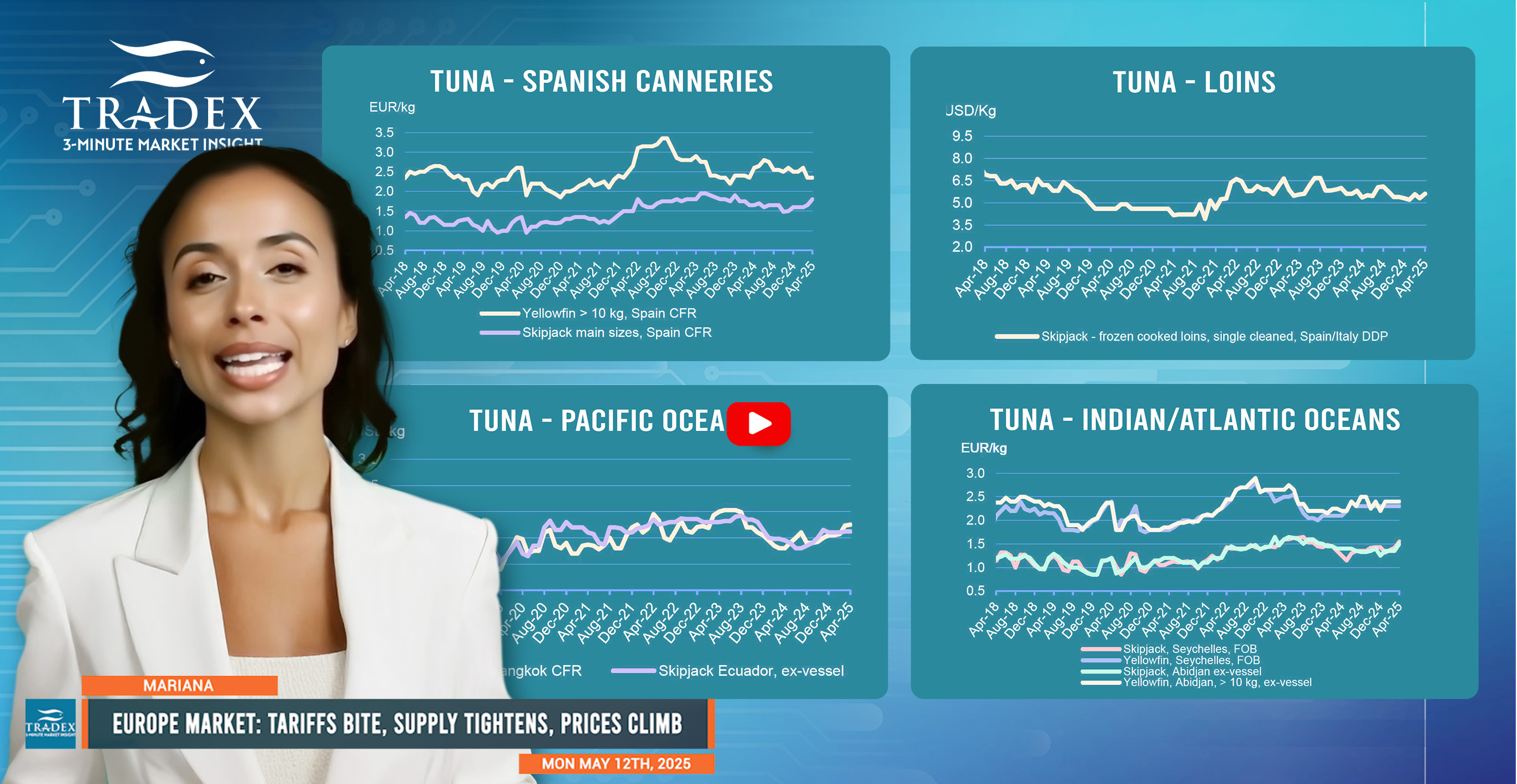

In the tuna market, skipjack prices continue to climb amid limited supply from the Pacific and Indian Oceans. Although yellowfin prices remain relatively stable, shortages and reduced output from canneries could cause upward pressure.

Cephalopod supply is similarly strained. South African squid catches are poor, leading to a significant price jump, while Indonesian octopus is being redirected to Europe and China as the U.S. market becomes less viable under the new tariffs.

Advertise Here: advertising@tradexfoods.com

The crustacean sector is also feeling the impact. Indian and Indonesian shrimp exports to the U.S. are down sharply, prompting suppliers to turn to the EU and Chinese markets. Prices have softened slightly, particularly for Indian products, but farming costs remain high. Ecuadorian shrimp continues to benefit from relatively favorable tariff conditions and is gaining market share.

Small pelagics like mackerel and herring have seen mixed results. Norwegian exports are down in volume but up significantly in value, with Poland, Egypt, and Germany remaining key destinations.

Meanwhile, the freshwater segment continues to grow. Pangasius remains a top choice for retailers and foodservice buyers due to its affordability and versatility, with Viet Nam leading as the primary supplier.

Salmon and trout are also trending upward. Norwegian salmon exports rose 16% in volume and 6% in value, supported by favorable biological conditions. Trout exports surged even more—up 39% in volume—as processors increasingly favor its lower price point compared to salmon.

With pricing volatility and global trade shifts in play, our recommendation to EU buyers is to act early—particularly for species like cod, squid, and shrimp where supply is tight and uncertainty remains. At the same time, alternatives like pangasius and trout are gaining favor as affordable, consistent options for value-added processing and retail.

With so much shifting in global trade and supply, staying flexible with sourcing and closely watching policy shifts will allow buyers to stay ahead and keep prices steady.

--- If you’re not already, be sure to subscribe to our 3-Minute Market Insight for seafood updates and insights delivered right to your inbox.