Loading

EP 477 | AIRED 03/02/2020

Coronavirus: China Insiders Update

March 2nd, 2020 --- In this week's episode we give you an "off the beaten path update" on the production conditions in China due to the Coronavirus.

Most plants in China have started production again, however access to the production facilities by outsiders are being strictly prohibited - this even includes government officials.

Our sources advised that only local workers are allowed to return to work in the plants.

Any workers from outside of the city (or that need to take public transportation to the plants) will have to be isolated for at least 14 days prior to returning to work. Government officials have arranged accomodations, but the processing plants are responsible for paying this and all other associated cost.

Quality Control Inspectors are still allowed into the plants for the final inspection before shipping so we strongly believe that quality will not be affected.

As for raw materials, because plants do not have enough workers, raw material demand has slowed as they don't need to purchase as much.

Post-Chinese New Year production would typically start up after the 2 week holiday, then 3-4 weeks to train the workers, so plants can be running full speed by a month and a half.

With the current workforce situation, we don’t believe plants will be able to run full speed within 4 months after the holiday (which is May).

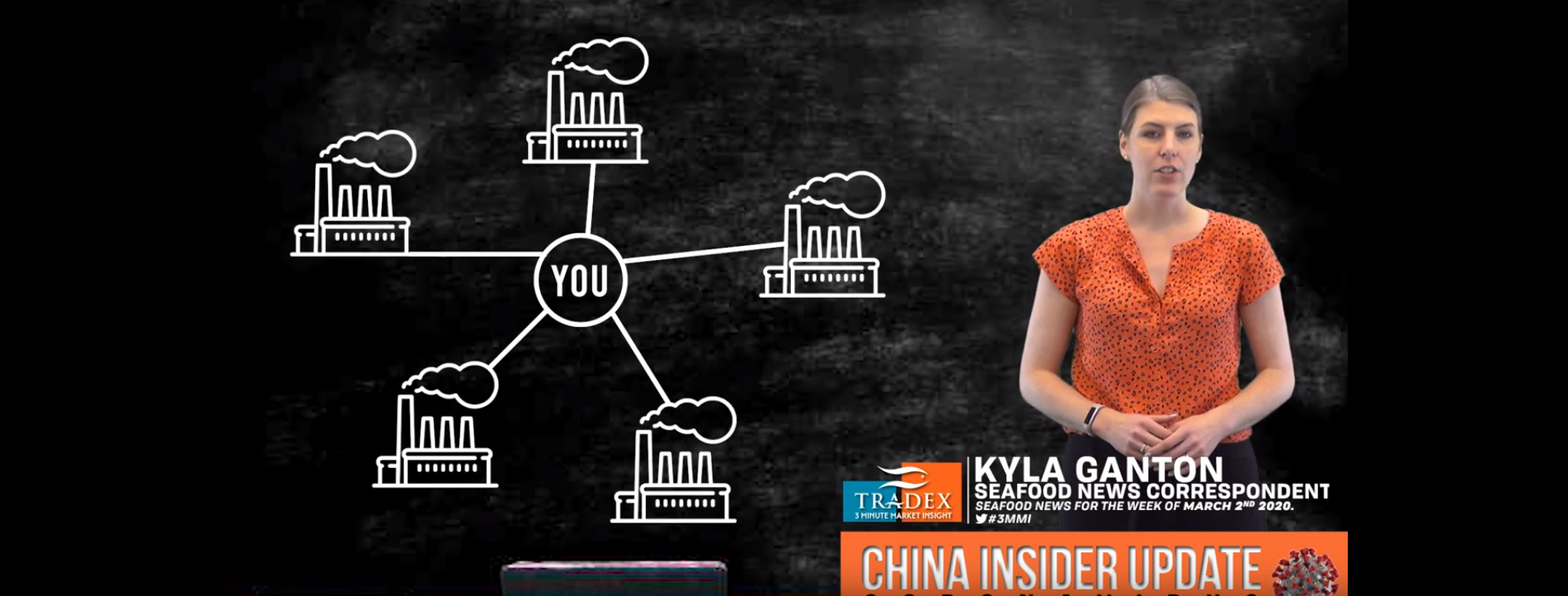

Now let's go over to Inventory and Logistics expert Kyla Ganton to hear what companies can do to control inventory during this Coronavirus disruption.

Well the problem with things like this (which the industry calls force majeure) is it was unpredictable.

So unless importers regularly hold several months of inventory on hand at a time, it is difficult if not impossible to close the supply gap.

With a 2-3 week delay back to work and a 30-50 percent plant capacity for several weeks, we are looking at a supply gap of nearly 2 months.

For importers, this means either depleting inventory levels or running hand to mouth as product begins to ship mid-March.

For customers, this means reaching out to several vendors to secure inventory until the supply chain has normalized.

For Inventory and Logistics Managers, it means prioritizing shipments so the plants know which are essential shipments to close supply gaps and which are maintenance shipments.

This is a great scenario where diversifying your supply chain is a strong strategy as the more plants you work with the better chance you have of shipments getting on the water as their employees return to work.

If you need some assistence with your inventory during this time of uncertainty, please contact us at Tradex Foods.

We are available everywhere from Webchat through our website to Twitter and Facebook.

If you have a topic you'd like to hear on upcoming 3-Minute Market Insights, tweet us on Twitter @TradexFoods