Loading

EP 468 | AIRED 12/16/2019

Pacific Cod, Pollock, Haddock Global Market Update

December 16th, 2019 ---- In this week's episode we go over Pricing, Catch Totals, and 2020 Quotas for Pacific Cod, Pollock and Haddock Globally.

Overall, Pacific Cod in Alaska will see a decrease in the Total Allowable Catch when compared to 2019.

The proposed 2020 TAC is currently set at 124,625 metric tonnes in the Bering Sea and 13,390 metric tonnes in the Aleutian Islands.

This equates to a decrease of 34 and 6 percent respectively from 2019's TAC of 166,475 and 14,214 metric tonnes.

--- As for the Gulf of Alaska, the Pacific Cod fishery will be closed for the first time ever with scientist and fisheries managers attributing climate change as a main factor for a potential stock crash.

NOAA Fisheries research bioligist Steve Barbeaux can be quoted saying - "Retrospectively, we probably should have shut the fishery down last year,"

The Total Allowable Catch in the Gulf of Alaska last year was 11,116 metric tonnes.

Pacific Cod harvest totals throughout 2019 were for about 181,600 metric tonnes in Bering Sea / Aleutian Islands and the Gulf of Alaska.

Moving on to Russia and the 2020 TAC set by The Russian Federation for Pacific Cod is to increase about 4 percent to 185,750 metric tonnes up from 178,300 metric tonnes in 2019.

2019 saw Russia Longline Pacific Cod earn MSC Certification where in 2020, 162,000 metric tonnes of Russian Pacific Cod will be available to be sold as MSC-certified.

Current raw materials pricing for Pacific Cod in China range from USD $3950/MT for Alaskan Longline to $2850/MT Russian FAS Trawl - this translates to about $1.79/LB to $1.29/LB USD.

During the same time last year, Alaskan Longline raw materials were as high as $4650/MT which translates to roughly $2.11/lb USD.

US tariffs, larger size and cheaper Russian Pacific Cod, and low demand from EU are contributing factors to the overall downward price trend throughout 2019 on Pacific Cod raw materials in China.

--- In Pollock the proposed 2020 Total Allowable Catch was set at 1.42 million metric tonnes in the Bering Sea, 19,000 metric tonnes in the Aleutian Islands, and 114,900 metric tonnes in the Gulf of Alaska.

On Dec 5 2019, The North Pacific Fishery Management Council approved a TAC for Eastern Bering Sea Pollock of 1.425 million metric tonnes, up 2 percent over the 2019 TAC of 1.397 million metric tons.

Overall, this means the TAC for Alaska Pollock will remain relatively the same from 2019.

Russia will see its Pollock TAC increase slightly to 1.83 million metric tonnes - an increase of about 2 percent from the 1.78 million metric tonnes in 2019.

December 2018 raw materials pricing in China saw Pollock at $1550/MT (or $0.70/lb USD) but then trended upwards mid year to around $1680/MT USD (or $0.76/lb USD).

Fast forward to December 2019 and current raw materials pricing for Pollock in China are can be seen as high as $1900/MT USD which translates to about $0.86/lb USD.

Our sources tell us plants are hoping to see pricing go down to $1250/MT (or $0.57/lb USD).

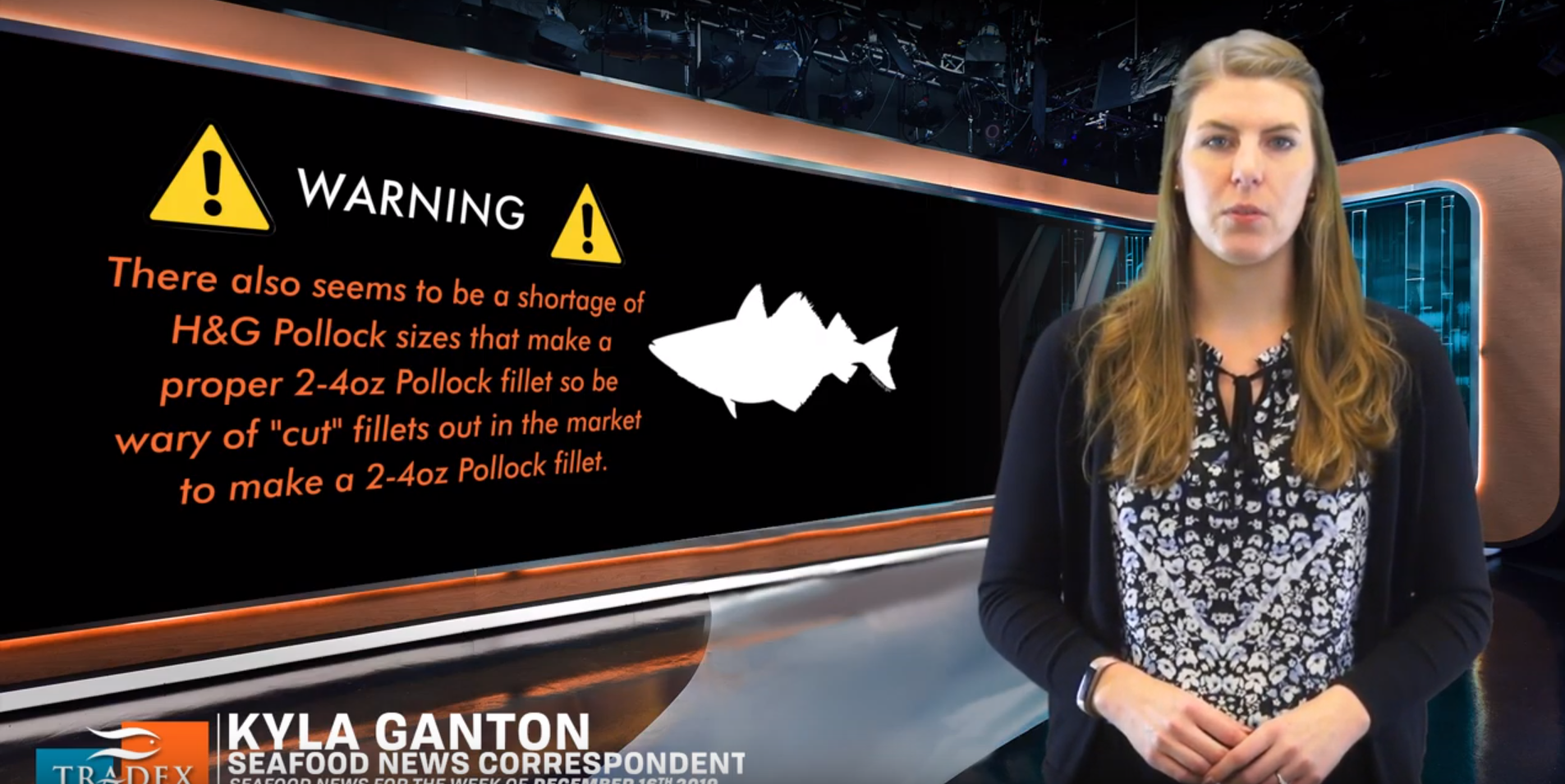

here also seems to be a shortage of H&G Pollock sizes that make a proper 2-4oz Pollock fillet so be wary of "cut" fillets out in the market to make a 2-4oz Pollock fillet.

There will be more 4-6oz, 6-8oz, and 8oz+ fillets available.

--- Lastly with Haddock, the International Council for the Exploration of Sea (ICES) recommended a Haddock Total Allowable Catch of 215,000 metric tons for 2020.

This is a 20 percent increase from the 172,000 metric tonnes advised for 2019 where roughly 89,560 metric tonnes have been harvested in Russian and Norwegian waters.

Current raw materials pricing for Haddock in China is $3150/MT (or $1.43/lb USD).

The market saw Haddock raw materials prices in China go from $3350/MT in December 2018, to $3500/MT in March 2019, then down to $3300/MT in July 2019 - which translates to about $1.50/lb USD.

In September, demand from US was still weak due to tariffs, the summer raw material pricing dropped to around $3100/MT, but the quality was not as good as Winter fish.

We could see a further raw materials price adjustment in the new year as we are told plants are hoping to see pricing at $2800/MT (or $1.27/lb USD).

--- OUR RECOMMENDATION IS to make your precommitments on Alaskan raw materials now as the value of Alaskan products are set to rise.

You can then balance out the rest of your needs with Russian Longline and Trawl raw materials.

If you have a topic you'd like to hear on upcoming 3-Minute Market Insights, tweet us on Twitter @TradexFoods