Loading

EP 459 | AIRED 10/14/2019

Halibut Market Update, Armchair Fishermen & Quota Leases

October 14th, 2019 --- As "Armchair Fishermen" pocket as much as 75 percent of profits and quotas are becoming monopolized, it was just a matter of time before this issue finally received Government intervention.

2019 Alaska Salmon Commercial Harvest Counter

(Harvest in thousands of fish)

| Chinook 274 |

Chum 18,390 |

Coho 3,723 |

Pink 125,883 |

Sockeye 55,331 |

Total 203,601 |

|---|

Updated: October 15th, 2019 8:00am (View Previous Weeks Totals)

Fisheries and Oceans Canada adopted individual transferable quotas (or ITQs) to manage several commercial fisheries in British Columbia including the Pacific Halibut fishery in 1992.

ITQs give their owners exclusive and transferable rights to catch a given portion of the TAC of a given fish stock.

ITQs can be owned by individual active and non-active fishers, non-fisher investors, vessels or enterprises, and are transferable through selling, buying and leasing in an open market all without any transparency regarding ownership.

Over time, some owners of ITQ's found they can make more money leasing out their quotas than fishing the quota themselves.

With higher revenues and better tax deductions, leasing quota is being treated like a pension, with some owners choosing to will the quotas to their family members to be used as an investment.

The House of Commons Standing Committee on Fisheries and Oceans held five public hearings between 30 January and 20 February 2019, during which it heard testimony from 40 witnesses.

The committee determined that the three main challenges affecting West Coast Fisheries are:

Inequitable Distribution of Risk and Benefits, Difficulty of Access for New Entrants, and Lack of Availability and Transparency Regarding Quota License Ownership and Socio-economic Data.

The committee went on to acknowledge that "when measured with an ecological yardstick, the West Coast fisheries appear to meet DFO's objectives.

However, in the view of the committee, DFO did not fully achieve its fisheries management framework's five objectives particularly on equitable distribution of benefits, economic viability of fishing operations, and data collection and analysis."

As the status quo is not economically and socially sustainable, the committee calls on DFO to facilitate, foster and implement grassroots initiatives for change.

We reached out to the International Pacific Halibut Commission for comments on this issue however they declined to provide a response.

--- Quota leasing does not seem to have an affect on pricing as the market still dictates that however the same can not be said for fisherman.

Listen to this testimony from commercial fisherman and director Fraser MacDonald on how their industry is affected.

Fraser McDonald: "My name is Fraser MacDonald, and I am a first generation fisherman from Nanoose Bay on Vancouver Island. I am a director on the BC Tuna Fisherman’s Association and a board member of the False Creek Fisherman’s Wharf in Vancouver. I had an experience in 2017 fishing leased halibut quota that illustrates how the current system is not balanced. In April 2017, I leased 32,000lbs of halibut quota through a buyer for $7.50/lbs, and this was the going lease rate at the time. The landed price had been between $9-$10 for the past two seasons, so we were hoping to get about $2/lbs gross to the boat after paying our lease. By August, the landed price had fallen to $7.50/lbs, so we waited right till the end of the season hoping the price would come up and in October there was a small profit to be made. However, because of a mechanical breakdown, we were unable to catch our entire quota before the season closure which meant I had to “carry over” the additional quota that I didn't catch into 2018. Unfortunately, the landed price of the fish at the opening in March 2018 a few months later was only $7.50/lbs the same price I had leased the fish for 12 months earlier. The 16,000lbs of quota I landed in April 2018 created no profit for my operation, but I still had to pay my crew and cover the costs of harvesting the fish. I arranged to borrow $30,000 from the buyer who leased the fish for me so we could pay my crew cover expenses. The two quota owners whom I leased from in 2017 got cheques for $120,000 each for their quota. My crew and I spent a month on the water and landed over $250,000 worth of fish, and I finished $30,000 farther behind from where I started. Not including the $50,000 in capital investment I spent on boat upgrades and gear rigging the boat for long-lining. Going fishing and losing money on a trip is very much a reality in this business and I accept that financial risk every time I leave the dock. However, it is a lot easier to accept a loss when the landed value of the fish simply doesn't cover the trip's expenses. In this case, the landed value was substantial; but my crew and I just weren't in on the take."

This year we were hearing lease prices in the $5 - $5.50/lb range with boats getting $2+ to the boat after the lease.

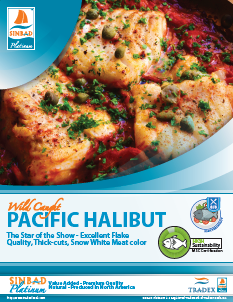

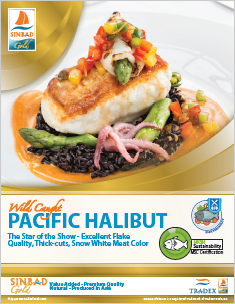

--- Now onto the update on the Pacific Halibut Market.

The 2019 Pacific Halibut Catch Limit was set at 29.43 million pounds - a 5 percent increase over 2018.

With about a month of fishing left latest catch figures are for an estimated 84 percent of the quota harvested.

In Alaska, about 80 percent of the catch went to the fresh market.

With about 20 percent of the catch going to the freezers, peak delivery times happened in June, July, and August.

Grounds prices overall this season were steady in the mid 5's to upper 5's on 10-20's with the exception during Alaska Salmon season where prices typically surge a bit due to a shortage of fresh.

Current pricing on frozen H&G Halibut inventories is around $7.00/lb for 10/20 LB and between $12.75/lb to $13.75/lb on frozen 1-3lb Halibut Fletches.

Industry experts predict a steady remainder of the year citing competition with East Coast Halibut and Farmed Halibut from Europe will keep Pacific Halibut prices in check in order to keep them on restaurant menus.

If you have a topic you'd like to hear on upcoming 3-Minute Market Insights, tweet us on Twitter @TradexFoods